Brunel Pension Partnership has achieved a 75.4% reduction in reserves intensity when compared to the 2019 baseline and a 64.5% reduction in reserves intensity across its portfolios, it announced in its 2023 Climate change progress report. This takes account of shifts between fossil fuels, as coal has a higher intensity than oil, it said.

The International Energy Agency (IEA) estimated that 80% of the world’s energy was based on fossil fuels in 2022.

In its World Energy Outlook 2022, the IEA used the Stated Policies Scenario (STEPS), which takes into account the measures that have been or are being implemented to achieve energy and climate policy goals.

On this basis, the share of fossil fuels in the energy mix falls to 75% by 2030 and to just above 60% by mid-century. This reduction is nowhere near steep enough for the world to reach net zero.

“The transition to the low-carbon economy calls for significant change in the shape and structure of our economy and requires us to eliminate most or all fossil fuel use and achieve a net-zero carbon economy by 2050,” the partnership stated.

Brunel said it actively seeks to reduce the dependence on fossil fuels through positive investment in low-carbon sources and engagement with companies to reduce both demand and supply.

It said: “We also seek to reduce our exposure to the fossil fuel industry whilst balancing the desire for real-world change that will reduce economy-wide carbon emissions.”

It added that it is important to identify exposure to business activities in extractive industries in order to assess the potential risk of assets that may suffer premature write-downs and even become obsolete due to changes in policy or consumer behaviour.

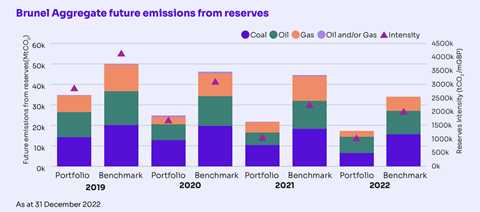

Brunel said it identifies the exposure to extraction-related activities for each portfolio by analysing the revenue exposure and potential emissions from reserves for fossil fuel-related activities.

These metrics highlight companies with business activities in extractive industries, as well as companies that have disclosed both proven and probable fossil fuel reserves in the portfolio. In other words, the metrics look at not just ‘fossil fuel companies’ but those companies that rely heavily on the fossil fuel industry for their own revenues, it said.

The 75.4% reduction in reserves intensity has been achieved through:

- decarbonisation of the Brunel portfolios;

- asset allocation changes between portfolios (due to client investment decisions);

- additional Brunel sub-portfolios launched in 2021 (FTSE Russell Paris-aligned benchmark series).

Brunel said that currently, its aggregate portfolio is less exposed to both fossil fuel revenues (1.30% vs 2.72% for its custom benchmark) and future emissions from reserves (17.3 MtCO2 vs 34.0 MtCO2).

It added that while Brunel’s exposure is “significantly below the benchmark” in all areas except one, its exposure to revenues from tar sands extraction is higher than the benchmark. It attributed this to two companies – Suncor and MEG Energy, which specialise in tar sands. Brunel said that these companies are held in its Global High Alpha fund.

“Brunel is actively engaging with managers on a wide range of companies whose business models are challenged by the desire to transition to a low-carbon future,” the report stated.

It added that there is “a tension between wanting to achieve real-world change through supporting those companies taking action and having investments in companies whose revenue streams are currently concentrated in areas where the transition is dependent on significant technological innovation, including those relating to carbon storage and capture”.

Scenario analysis

The report also disclosed that Brunel will work closely with S&P to help with scenario analysis for physical climate risk. The move comes ahead of new Taskforce on Climate-related Financial Disclosures (TCFD) regulation for pension pools.

“During 2022-23, we have been exploring data and analytics provider options to ensure we meet the newly proposed TCFD-aligned reporting requirements which will require LGPS [Local Government Pension Scheme] fund-level climate reports, from the Department for Levelling up, Housing and Communities (DLUHC) and the FCA {Financial Conduct Authority],” the report noted.

In addtion to its own current carbon metrics, Brunel said that using data and analytics from S&P will allow the pool to analyse companies’ exposure to physical risk from climate change under varying future scenarios, analyse portfolio alignment and understand potential earnings at risk from carbon pricing at a portfolio level.

“We are still assessing the more appropriate metrics to report on as we await final guidance from DLUHC,” Brunel said.

Read the digital edition of IPE’s latest magazine