UK-based pension fund sponsors have reported that the professional corporate sole trustee (PCST) model improves governance, efficiency and speed of decision making for their schemes.

A report by Independent Governance Group (IGG) – PCST 360 – has drawn from both sponsors and leading advisory firms, to understand the experiences and expectations of the entire PCST market.

Every sponsor surveyed reported improved governance as a result of appointing a PCST. Almost three in five (58%) said the governance improvements were “significant”.

Four in five sponsors (79%) said they now spend less time managing their pension funds, ensuring they can focus on other priorities to effectively run their businesses.

IGG said it has been monitoring attitudes towards the growth of PCST appointments through the lens of advisory firms since 2022. Its latest study captures views from 12 leading firms that collectively advise almost 10,000 schemes, including more than 1,000 where a PCST model is in place.

In the latest survey, IGG has also examined the outcomes experienced by scheme sponsors who have chosen to appoint a PCST.

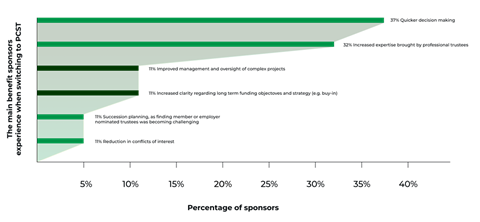

Asked about the main benefit they have seen since making the switch, 37% of sponsors cited quicker decision-making – highlighting how the streamlined PCST approach can enable more decisive action.

Almost one in three sponsors (32%) singled out increased expertise as the main benefit, with 79% experiencing this benefit overall.

Advisory firms also pinpointed quicker decision-making as the key benefit driving sponsors to consider the PCST model, followed by increased expertise and reduced demands on time for sponsor management.

A survey from LCP, published in September, suggested that 25% of UK pension schemes now have a PCST in place, up from 12% in 2021. A separate analysis from Hymans Robertson, published in July last year, showed that PCSTs account for 42% of professional trustee firms’ appointments, compared with 35% in 2023.

Looking ahead, IGG’s research shows a large majority of advisory firms (83%) expect growth to continue in 2026. This includes 25% who expect ‘significant’ growth. The overall figure is only modestly down from 2025, when 93% of firms expected the adoption of the PCST model to grow.

The report shows that advisers note that many mid-to-large pension funds are being impacted by the same factors that have driven wider adoption among small schemes. These include increasing complexity, regulatory requirements and resourcing challenges. This is backed up by IGG’s own experiences of increasing PCST appointments by larger schemes with upwards of £500m or £1bn of assets under management.

Other factors expected to fuel uptake, according to IGG, include developments in The Pensions Regulator’s oversight framework and the challenge of managing the complex market environment. Advisory firms also report that many schemes where a professional trustee has already been appointed intend to move to PCST in the next 12-18 months.

However, IGG said that those firms that expect growth to slow suggest that some sponsors have already ruled out the PCST model in favour of a co-trustee approach.

Annabelle Hardiman, trustee director and head of PCST at IGG, said: “For the first time, we have expanded our PCST 360 Report to include insights from sponsors as well as advisers, providing a 360-degree view of attitudes towards the PCST model.

“Governance pressures mean sponsors continue to spend a material amount of time on pension matters, with pension schemes constantly having to adapt to market and regulatory complexities while juggling internal resource challenges.”

She added: “Doing the right thing for members in this new context often means revisiting what’s worked in the past and weighing up alternatives to ensure sponsors have the best solution in place for today’s realities.”

Hardiman noted that while no one approach is right for every scenario, implementing a PCST model typically results in quicker and more agile decision-making, simplified governance as well as the efficiencies that come with greater access to professional expertise.

She continued: “The PCST model has emerged as an attractive and increasingly well-established solution, to the extent that for many sponsors, the question is no longer whether it works, but actually when it becomes the right option for their scheme. There are clear signs that more sponsors of mid-to-large schemes are already asking themselves this question, but it is important to ensure that members and existing trustees are taken on the journey.”