Many pension funds in the Netherlands have eliminated their entire exposure to hedge funds in recent years, or are in the process of doing so. But because of the changes in the macro environment there are now more reasons than ever to invest in hedge funds, according to consultants.

The high fees charged by hedge funds, despite relatively low returns, and a lack of transparency about the underlying strategies are cited most often by pension fund boards as reasons to exit the asset class.

Pension funds PMT, PME, PFZW, Fysiotherapeuten, Provisum and the staff pension fund of pension asset manager APG are just some of the funds to have said goodbye to hedge funds for these reasons in the past few years.

Back in 2015, APG chief investment officer Ronald Wuijster told IPE he was “happy” with his firm’s hedge fund portfolio which was “recording good results”. But clearly something changed in subsequent years as APG’s own pension fund quietly divested from hedge funds back in 2018.

ABP and Huisartsen, the fund for doctors, are reducing their exposure to hedge funds with the view to exit the asset class completely by next year.

As a result of these disinvestments, the hedge fund allocation of the Dutch pension fund sector has come down from 2.4% in 2015 to 1.4% at the end of last year.

Once ABP has finalised the sale of its €20bn hedge fund portolio by the end of 2022, all pension funds together will have invested less than €4bn to hedge funds. This is less than 0.25% of total pension assets.

Four funds standing

Only four Dutch pension funds still retain a strategic allocation to hedge funds, according to research by IPE. These are the sector funds Bouw and Woningcorporaties, the Shell pension fund and SPMS, the fund for medical specialists.

Woningcorporaties, which has outsourced its asset management to APG just like Bouw and ABP, reduced its allocation to the category from 5% to 4% in 2019, citing relatively high costs.

In 2019 the fund paid 2.5% in management and performance fees to hedge fund managers while the asset class returned a net 6.7%. This compares to an average 0.7% for 2019 in asset management costs for all investment categories.

Fee reductions

Both Bouw and SPMS said they realised hedge fund fees are relatively high. Both funds have therefore tried to negotiate lower fees, they told IPE. Bouw managed to reduce fees by 27% since 2015, according to trade publication Pensioen Pro.

SPMS accomplished cuts in both management and performance fee payments, said the fund’s CIO Marcel Roberts.

“Management fees have been reduced by up to 25 basis points, and in some cases we have been able to negotiate down performance fees by up to 40%,” he told IPE.

Moreover, the hurdle rate, the minimum return a manager must achieve before being eligible for performance fees, has also been increased.

“Often this was at money market level, but with some managers we increased it to 1.5% to 4%. With every single manager we have been successful in our fee negotiations,” he said.

Toby Goodworth of bfinance, which advises pension funds on asset manager selection, has also noticed hedge funds are under pressure to reduce fees. “Fees are an important aspect for selection of hedge fund managers,” he said.

Average management fees are about 1.6% while performance fees are approximately 18%, according to Goodworth. This is slightly below the ‘2-20’ cost standard.

“2-20 is still perceived to be the average. But it’s not the standard now, if it ever has been as costs depends very much on the underlying strategy. You’re much more likely to see a 2-20 type of fee structure with discretionary global macro, for example, than for managed futures or equity market-neutral,” he added.

Diversification

The successful cost negotiations have strengthened SPMS and Bouw in their conviction to remain invested in hedge funds.

“The goal of our hedge fund allocation is diversification. The returns of our managers tend to be uncorrelated to market performance. This costs money, but it reduces the overall risk of the portfolio,” said Roberts.

“The goal of our hedge fund allocation is diversification”

Marcel Roberts, CIO at SPMS

Bouw invests in hedge funds for similar reasons. “The volatility of our hedge fund portfolio is relatively low compared to other equity investments. Because we use a mix of strategies, the volatility of our hedge fund portfolio is comparable to fixed income,” noted the fund’s director, David van As.

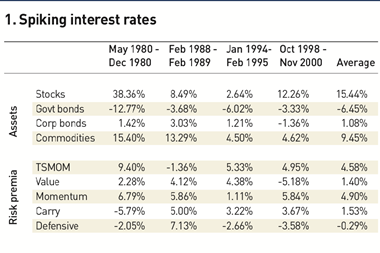

“Especially this characteristic of risk diversification has perhaps been underappreciated in the past decade as returns on traditional asset classes continued to edge higher. But we could be on the eve of a turning point,” Goodworth said.

He added: “The past few years we saw little appetite for hedge funds in client searches. In Q4 2020 we saw a switch, with more significant interest in allocating towards hedge funds. The driver is better diversification and a hedge against equity risk, as investors have noted correlation between equity and bond markets has increased.”

He continued: “Whether this is an elective move or one out of necessity, is hard to define, but we’ve seen this trend continue materially this year as we are asked to look for strategies that provide more consistently diversified return streams.”

Rob Kamphuis, head of portfolio advice at Willis Towers Watson, has also noted the tables turning for hedge funds.

“In the past few years you didn’t really need them, because traditional investments were providing acceptable returns. But this is now changing, so we believe it’s now more important to allocate to sources of return that are not correlated with the market. Hedge funds are an example of such an investment.”