Soaring markets over the third quarter of 2019 pushed Spanish occupational pension fund returns to 4% for the 12 months to 30 September 2019, according to the country’s Investment and Pension Fund Association (Inverco).

The figure compared with a 2.9% average return for the 12 months to 30 June 2019, and a 0.7% return for the 12 months to end-September 2018.

The third-quarter figures brought the average annualised returns for Spanish occupational funds to 2.9% for the three years to end-September 2019, and 2.8% for the five-year period.

Inverco said stand-out performances were achieved by those pension funds with greater exposure to long-term fixed income, after the sharp revaluation of 10-year Spanish government bonds.

Xavier Bellavista, principal at Mercer, said: “Equity performance has been extraordinary, with double digit performance in all asset classes, but all fixed income asset classes have also done exceptionally well.”

Separate figures from Mercer’s Pension Investment Performance Service (PIPS) showed that the median pension fund return over the first three quarters was 6.3%. The PIPS survey covered a large sample of pension funds, most of them occupational schemes.

However, Bellavista warned: “This extraordinary median performance includes a high dispersion of returns among funds. This dispersion means some pension funds are not achieving their minimum objective of beating inflation in the mid- to long term.”

“Equity performance has been extraordinary, with double digit performance in all asset classes”

Xavier Bellavista, principal at Mercer

He said the funds with the best performance over this period, in all risk profiles, were those with better diversification and without a European bias in their asset allocation.

According to Bellavista, the most significant change in asset allocation among Spanish corporate pension funds over the past five years has been the emergence of non-euro fixed income as a key asset.

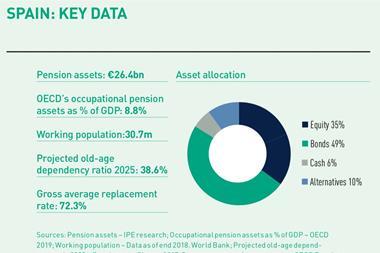

Meanwhile, according to Inverco, while Spanish government bonds continue to decline in terms of importance – five years ago they made up over one-third of the average pension fund portfolio – they still form 20.6% of assets.

Other long-term shifts have continued, with the average fixed income allocation falling slightly over the third quarter to 46.4% of portfolios. The equity allocation rose to 36.4% as at end-September 2019, with 23% in non-domestic stocks.

The average allocation to domestic securities at end-September 2019 remained stable at 53.1% of portfolios, compared with 33.7% in non-domestic assets.

According to Inverco, total assets under management for the Spanish occupational pensions sector at the end of September stood at €35.5bn, a 1.2% increase over the past year. The number of participants in the occupational system remained static at just under 2 million.