Sponsors and trustees of UK defined benefit (DB) pension schemes have raised concerns about additional costs that complying with The Pensions Regulator’s (TPR) new funding code may bring.

According to recent research conducted by Hymans Robertson, nearly half of trustees and sponsors (42%) are concerned about the additional governance challenges, and in turn associated costs, that the code will bring.

With the regulator having flagged best practice about the expected changes for a number of years, the research results suggest that only 10% of trustees and sponsors think that the draft code will lead to a significant change of their current plans.

Around a quarter (22%) believe that while changes from the code may be straightforward, the associated costs and additional compliance may be more complicated. Just over half (52%) of trustees and sponsors will use the code as an opportunity to review, and sense check, their long-term strategy.

This underscores the delicate balance between TPR bringing a minority into line and the new requirements adding an additional layer of compliance for schemes who are already doing the right thing.

Laura McLaren, partner and head of scheme actuary services, said that although the DB funding code won’t be in place before October at the earliest, most pension fund trustees have already been looking ahead to the coming changes.

“However, all schemes are still going to have to do more governance-wise, to map out future strategy in the format required and report on progress. With many plans in good shape, it is perhaps not surprising to see a focus on this additional paperwork and the associated compliance costs,” she said.

“Until both the code and the regulations are finalised, some caution remains in regard to the overall cost impact,” McLaren said, adding that the rigidity of the Department for Work and Pensions’ (DWP) regulations, in particular, was a “gnawing concern” despite there being a lot more flexibility in the code itself.

Adam Gillespie, partner at XPS Pensions Group, had a similar take. He beileives that investment planning will play a pivotal role in the new regime and trustees and sponsors will have to quickly grapple with new concepts such as a low dependency investment allocation, covenant reliability and high resilience.

“Whilst there is a lot of detail in the 200+ pages of drafts and consultation documents, ultimately there may be more options and flexibility with your long-term investment strategy than you previously expected. The clock is already ticking for schemes and most will now have materially less time to get to their end targets than previously anticipated,” he explained.

“This tension needs resolved with amendments to the regulations to ensure TPR’s framework will work as intended,” McLaren said.

Regulatory background

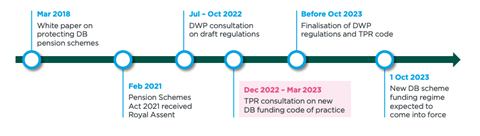

The new DB funding code has been in the making since the UK government’s 2018 white paper. Whilst high-level principles of the new regime came into force via the Pension Schemes Act 2021, there are now two important updates.

Firstly, DWP published its draft regulations in July 2022, which provide much needed detail on the new legal requirements that will be put on trustees and sponsors.

Secondly, in December 2022, the regulator launched its second consultation on its new code of practice for funding DB pension schemes, which sets out the regulator’s interpretation of how to comply with the new legal requirements. It is important to note that the code is not a statement of the law, but clearly it is helpful for trustees and sponsors to understand how the regulator will look to govern in the new strategy regime.

Schemes do not need to wait for the final version of the new code or regulations before thinking about how the new strategy regime could affect them. This is especially true given market conditions – the time until significant maturity will have reduced materially for most schemes during 2022 simply as a result of higher Gilt yields.

The new funding code regime is expected to come into force no earlier than 1 October 2023.

The latest digital edition of IPE’s magazine is now available