All Opinion Pieces articles – Page 27

-

Opinion Pieces

Opinion PiecesViewpoint: How trustees can create practical carbon journey plans

Dealing with climate change is a responsibility we all share – but trustees may be wondering how they get from their starting point to the required end-goal. This ‘carbon journey’ needs a plan.

-

Opinion Pieces

Opinion PiecesViewpoint: The Norwegian Government Pension Fund is plain wrong!

The UN PRI is right to get real and dismiss those who sign up under false pretences – good riddance to hypocrisy

-

Opinion Pieces

Opinion PiecesLetter from US: COVID-19 places new demands on university endowments

COVID-19 has hit a special category of institutional investors in the US hard – college and university endowments. In fact, higher education institutions are facing a decline in revenues because of fewer students enrolling and paying tuition, as well as current students asking for more financial aid. Colleges and universities are withdrawing substantial amounts from their endowments to cover these extra expenses. How is this affecting endowments’ investment strategies?

-

Opinion Pieces

Opinion PiecesLetter from Australia: Reforms not super for default funds

A string of government reforms due to come into effect from July 2021 has caught the superannuation sector off-guard.

-

Opinion Pieces

Opinion PiecesGuest viewpoint: Sir Ronald Cohen

We are on the threshold of another major shift in institutional portfolios. Impact transparency is changing the rules for both investors and businesses.

-

Opinion Pieces

Opinion PiecesJobs crisis threatens pension provision

Hopefully one of the few benefits of the COVID-19 crisis will be to show that the impact of an ageing population is exaggerated. There are other key elements informing the ability of a society to provide decent pensions by whatever means.

-

Opinion Pieces

Opinion PiecesDeleveraging is no free lunch

After temporarily shutting down the global economy, governments are pursuing a massive fiscal expansion in order to support struggling businesses and consumers.

-

Opinion Pieces

Opinion PiecesResilience: how investors can secure it

Back in March 2020 as the extent of the coronavirus in western Europe was becoming clear, Risto Murto, president and CEO of the €49bn Finnish pension insurer Varma, called for the creation of “healthcare buffers” to mitigate the effects of future pandemics.

-

Opinion Pieces

Opinion PiecesImprovement required

Climate change will continue to be one of the most economically impactful events as it affects us all. It requires immediate and ambitious action to prevent the worst effects on people and biodiversity and it signals a message that nations need to build a more resilient and sustainable global financial system.

-

Opinion Pieces

Opinion PiecesPerspective: Markowitz is still modern

Thirty years after he was awarded the Nobel Memorial Prize in Economic Sciences, Harry Markowitz’s groundbreaking work from the 1950s still powers financial innovation

-

Opinion Pieces

Opinion PiecesIs sustainability mispriced?

Living in the developed world over the past 50 years, life has been stable, even idyllic, for most people. That is certainly compared with their grandparents and previous generations who lived through two world wars and the Spanish flu. But, as COVID-19 has shown so cruelly, there are existential dangers that can lie hidden. These can rip the established world order asunder if not tackled beforehand.

-

Opinion Pieces

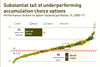

Opinion PiecesThere is such thing as a (fossil) free lunch

A major historical fear has been that very strict exclusion or integration policies can lead to significant changes in the risk-return profile of portfolios

-

Opinion Pieces

Opinion PiecesViewpoint: The tipping point for UK pension schemes

Schemes need to consider how to get to a secure level of funding, but also, the assets they will need to hold when they reach peak cashflows in order to remain fully funded

-

Opinion Pieces

Opinion PiecesViewpoint: Why Europe needs a real pan-European occupational vehicle

The revision to the Directive, known as IORP II, did not really facilitate cross-border activities. On the contrary, it seems that some EU member states have taken the implementation of the Directive as an opportunity to further complicate cross-border activities.

-

Opinion Pieces

Opinion PiecesViewpoint: Mastering human rights risks – Why asset managers should act now

Sustainable investing has been a hot topic among investors for some time, with a particular focus on environmental, social and governance (ESG) factors. Throughout the COVID-19 pandemic, ESG stocks and assets have outperformed the market. While the ’S’ has often been overlooked, recent trends are fuelling attention on the cornerstone ...

-

Opinion Pieces

Opinion PiecesSmart phones: the key to African opportunity

Demographics are often the least appreciated of the long-term trends that investors consider, despite being perhaps the most important.

-

Opinion Pieces

Opinion PiecesLetter from Australia: Funding the future world

A handful of Australian superannuation funds are committing their members’ savings to the future world in terms of energy, water, technology and ideas. There will be successes and failures as ideas are developed and marketed.

-

Opinion Pieces

Can superfunds be the silver bullet for DB woes?

Consolidation as a means of achieving better outcomes for pension schemes is a growing trend. This was highlighted in the UK’s Department for Work and Pensions’ (DWP) 2018 White Paper on protecting defined benefit (DB) pension schemes.

-

Opinion Pieces

Opinion PiecesLeading viewpoint: Closing ESG reporting gaps

Asset managers seeking a coherent ESG strategy first need a coherent narrative

-

Opinion Pieces

Opinion PiecesLeading viewpoint: How great companies deliver purpose and profit

Shareholder value creation is good for companies, investors and the wider world