- Save article

- Save articleNews

Ageas, Emergo Wealth target first-wave PEPPs

However, interest is low as fee cap and mandatory advice requirements weigh in

- Save article

Special Report

Special ReportWeighing the costs and benefits of making a claim

ABN-Amro, Airbus, ING, Petrobras and Stellantis are among the major corporations defending class action lawsuits in the Dutch courts. They are likely to be joined by Philips within the next 12 months.

- Save article

News

NewsPeople moves: Redington’s chief to step down

Plus: LGPS Central to replace chair Joanne Segars; Aon MasterTrust appoints independent trustee

- Save article

Interviews

InterviewsPrivate equity remains a key building block for pension schemes

While allocations vary, pension funds value solid returns and private equity’s role as a diversifier. Funds use PE to gain both domestic and international exposure.

- Save article

Special Report

Special ReportSpecial Report – Pan-European Personal Pensions

From March, the European Commission’s vision of a simple, cross-border savings product becomes a reality with the launch of the Pan-European Personal Pension Product (PEPP). EU citizens will for the first time be able to channel savings into a long-term third-pillar product that is cost effective, simple and portable across borders.

- Save article

Special Report

Special ReportUK group litigation funding: Devil in the detail

Third-party litigation funding (TPLF) has become a key ‘must-have’ for opt-in group litigation in Europe, but in July 2023 the UK Supreme Court made a ruling that potentially threw a spanner in the works for such funding used in UK lawsuits.

- Save articleSpecial Report

Credit: A third way

Liam Kennedy outlines how Natixis, in partnership with insurers Ageas and CNP Assurance, has created an alternative to direct infrastructure lending and investment through funds

- Save article

Country Report

Country ReportPortugal: Pension funds navigate uncertain times

Schemes are employing defensive measures to protect against portfolio risk

- Save article

Opinion Pieces

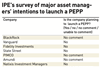

Opinion PiecesPEPP could be a slow-burn success if big asset managers help

When early pan-European pension concepts took shape, spearheaded by the late Koen de Ryck of Pragma Consulting and his groundbreaking 1996 report, there was a vision that cross-border pension provision by the likes of Unilever and Shell would provide a European model for DB pensions that would boost labour mobility, take workplace retirement provision to under-served markets and set standards for the future.

- Save article

News

NewsDutch court approves €1.3bn Fortis settlement

Nearly a decade after the Belgian-Dutch bancassurer collapsed, institutional investors have a result

- Save articleNews

IPE Awards: PPF wins European Pension Fund of the Year

Heribert Karch receives Outstanding Industry Contribution award

- Save articleNews

IPE Awards (Country & Regional): PensionDenmark wins for Denmark, Bosch for Germany

Construction Workers Pension Scheme wins for Ireland and the Environment Agency Pension Fund for the UK

- Save article

Special Report

Special ReportClass actions: Is Europe catching up with the US?

Europe’s institutional investors are latching on to the rewards of joining class actions against investee companies. Many of these are securities lawsuits, pursued when a publicly listed company has not properly disclosed or has misrepresented significant information, affecting the share price when the truth emerges. But so far, the vast majority of these have been in the US. In 2022, nearly $4.9bn (€4.6bn) was recovered in the US courts, according to Institutional Shareholder Services. So, what about class actions in Europe? “The US has had a class action system for over a hundred years that can be adopted for almost every cause of action, whereas the UK has only had class actions since 2015 and it is only available for competition cases,” says Harry McGowan, partner in the securities litigation department at law firm Stewarts.

- Save article

Special Report

Special ReportShareholder class actions in Europe: the benefits and risks of participating

Litigation outside the United States, and in particular in Europe, has been on the rise since the US Supreme Court’s landmark 2010 decision in Morrison v. National Australia Bank. In Morrison, the US Supreme Court ruled that “foreign” (non-US) investors cannot bring federal securities lawsuits in US courts to recover investment losses relating to foreign-issued securities traded on foreign exchanges (known as “F-cubed” claims). As former Justice Antonin Scalia explained, the concern was to prevent the US from becoming “the Shangri-La” of class-action litigation for lawyers representing those allegedly cheated in foreign securities markets. Although federal courts have since struggled to apply Morrison’s effect test consistently, it is clear, more than 10 years later, that the decision has had its intended effect.

- Save article

Special Report

Special ReportPEPP: Few players on the starting line

In March, the European Union’s Pan-European Personal Pension Product (PEPP) framework comes into effect, amid doubts about the take-up by providers

- Asset Manager News

AEW Europe supports the development of Lola & Liza which expands on 1,100 sqm in Brussels

AEW Europe, as asset manager for Le Marquis, expands the Lola & Liza Group on 1,100 sqm at 1, Rue du Marquis in Brussels

- Save article

News

News'Misled' investors file class action against Fortis

GLOBAL – A new foundation, Investor Claims against Fortis, has started legal proceedings in the Netherlands against the former bancassurer Fortis for "misleading investors", which it claims led to combined losses of €2bn.

- Save article

News

NewsOur Man in Brussels: The Eurofi Forum's take on pension reform

EUROPE – The challenge of progressing EU pensions policy along the lines suggested in the European Commission's Green Paper may seem overwhelming.