All IPE articles in September 2020 (Magazine)

View all stories from this issue.

-

Special Report

Special ReportTop 1000 Pension Funds 2020: Europe’s €8trn pension pot

This year’s 7.25% increase in overall assets for IPE’s Top 1000 European Pension Funds 2020 sample to €8.3trn must inevitably be seen in light of 2019’s strong year for asset returns and 2020’s tumultuous COVID-19-related market crash. By comparison, the overall asset increase in 2019’s survey was 6.93%.

-

-

Special Report

Special ReportSpain: COVID-19 lays further obstacle on road to reform

Pandemic disrupts the latest government’s progress towards reform of the country’s pension system

-

-

-

Features

FeaturesIPE Quest Expectations Indicator September 2020

US COVID-19 figures are receding, to the extent that Brazil has taken over as the world’s worst managed country. A number of western European countries are experiencing a minor rebound, likely because of holiday travel. India has suffered a high death toll but this is partly a reflect of its huge population.

-

Features

Accounting matters: Totalling the sub-totals

A project that at its simplest is about the layout of financial statements should be uncontroversial. But the International Accounting Standards Board’s Primary Financial Statements project faces a potentially big test.

-

Special Report

Special ReportNorway: Sustainability and retirement age under review

The government convenes a panel of experts to assess the state of the country’s pension industry in light of the 2011 reforms

-

Special Report

Special ReportNetherlands: Social partners agree on switch to DC pensions

A new pension contract, aimed at sharing risk and reward across the generations, has been agreed after years of negotiation

-

Features

Ahead of the curve: Alternative data offers insight

The measures required to stop the spread of COVID-19 – social distancing and government-mandated lockdowns – mean that, unlike in previous recessions, services have led the economic decline.

-

Book Review

Book ReviewBooks: It all boils down to the three Ds

Paul Marshall’s pocket guide to fund management covers multiple subjects, each of which really deserves its own book. Nonetheless, he writes well, and has produced a diverse and entertaining work.

-

Asset Class Reports

Asset Class ReportsSmall caps: All is not lost

Some small-cap companies have not only survived effects of the pandemic but are even thriving

-

Country Report

Country ReportNetherlands: Pension managers take alternative routes

Dutch pension managers are responding in different ways to the challenges of investing in alternative and illiquid asset classes

-

Features

FeaturesFixed income, rates, currencies: Still facing anxious times

Developed market government bond yields have spent the summer drifting lower as risk assets traded better. However, this benign climate has not lifted the fog of confusion caused by COVID-19.

-

Opinion Pieces

Opinion PiecesLetter from US: Diversity in asset management rises

“It is a part of your fiduciary duty to invest the fund’s assets in a prudent manner. Investing with diverse asset managers that demonstrate outperformance and deliver strong returns is more than prudent, it is wise.”

-

Opinion Pieces

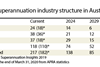

Opinion PiecesLetter from Australia: Pooling for savings and strength

The government, the regulator and economic fallout from COVID-19 have combined to pressure Australia’s large and unwieldy pool of super funds towards consolidation.

-

Special Report

Special ReportAustria: New government, old dilemmas

The new coalition government has made slow progress towards pension reform

-

Special Report

Special ReportBelgium: Steady as she goes

Improvements to the country’s pension system have continued in the face of persistent political problems and the global health crisis

-

Special Report

Special ReportIreland: Pandemic delivers policy blow

The roll-out of auto-enrolment has been postponed and the IORP II Directive is expected to be implemented by the end of this year

-

Special Report

Special ReportFinland: Tripartite blueprint set to unify pensions

The government pushes ahead with plans for the most extensive reform of the public and private pensions systems in decades