All Special Report articles – Page 5

-

Special Report

Special ReportWeighing the costs and benefits of making a claim

ABN-Amro, Airbus, ING, Petrobras and Stellantis are among the major corporations defending class action lawsuits in the Dutch courts. They are likely to be joined by Philips within the next 12 months.

-

Special Report

Special ReportSecurities litigation: the view from our institutional clients

Over the last year we have continued to see a steady stream of new group investor actions brought across Europe, arising from serious alleged governance failures.

-

Special Report

Special ReportUK group litigation funding: Devil in the detail

Third-party litigation funding (TPLF) has become a key ‘must-have’ for opt-in group litigation in Europe, but in July 2023 the UK Supreme Court made a ruling that potentially threw a spanner in the works for such funding used in UK lawsuits.

-

Special Report

Special ReportPassive investors: price/market reliance and the due diligence question

Towards the end of October 2024, the High Court in London struck out claims for £335m (€402m) being sought from Barclays for misdemeanours dating back over ten years.

-

Special Report

Special ReportInvestor litigation outside the US on the rise

Class-action lawsuits have been a staple of the litigation landscape in the US for decades, but this trend is now spreading, with investor litigation on the rise across the UK and Europe

-

Special Report

Special ReportESG: Investors embrace new challenges on 1.5°C climate goal

The world has changed considerably since we first started publishing this annual special report in 2018, not least in that the rise of greenwashing concerns is leading to a phasing-out of terms such as ESG.

-

Special Report

Special ReportNew ways of looking at corporate carbon mitigation activities

A new label could help investors identify companies that take a holistic approach to carbon reduction

-

Special Report

Special ReportAsset owners confront waning resolve of their managers on climate change

Will the notable exits from Climate Action 100+ and other investor coalitions influence manager selection decisions for European asset owners?

-

Special Report

Special ReportInvestors await influx of standardised corporate sustainability data

New EU corporate sustainability reporting standards will drive disclosures on hundreds of datapoints by thousands of companies.

-

Special Report

Special ReportCan banks move the dial on carbon emissions?

Despite their high-profile commitments, the banking sector’s progress on reducing lending to high emitters is far from clear

-

Special Report

Special ReportInvestors raise their voice in responsible investment policy debate

Investors once shied away from the murky business of lobbying but now they are changing their tune

-

Special Report

Special ReportPension funds outline progress towards net zero

Europe’s leading pension funds talk about their journey to net zero so far

-

Special Report

Special ReportIndex 2.0: Off-the-shelf or custom indices?

Continuing innovation in the index business leads investors to address a fundamental question – should they buy off-the-shelf products or customise their own?

-

Special Report

Special ReportCan active ETFs give institutional investors more choice?

Pension funds are increasingly showing interest in active ETFs for their flexibility, cost-effectiveness and ability to generate value beyond index returns

-

Special Report

Denmark's PKA transitions most of equity portfolio to bespoke ESG swaps

PKA, the Danish occupational pension fund for the social and healthcare sectors, transitioned the majority of its global equity portion in June to direct indexing for its total return swaps (TRS) trades to better implement its sustainability criteria.

-

Special Report

Special ReportThe case for custom indices to meet sustainability goals

Asset owners are increasingly seeking more bespoke solutions to meet their sustainability goals

-

Special Report

Special ReportHave factor investing strategies had their day?

Factors have inspired indices, spin-offs and a variety of investment strategies but it has become hard to argue that they will offer investors a persistent future premium

-

Special Report

Special ReportTop 10 European pension funds raise equity and bond exposure

Pension funds in most European countries recorded strong returns of between 6% and 9%, according to preliminary figures published this summer by the OECD.

-

Special Report

Special ReportTop 1000 Pension Funds 2024: Pensions back at a sweet spot

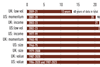

Assets for the leading 1000 European pension funds grew by 8.7% year-on-year, reversing last year’s loss of 6.8%. This brings total assets back up to above their previous high water mark of €9.7trn in 2022’s research exercise. This year’s overall net gain in assets of €775bn is the largest since 2021’s increase of €810bn.

-

Special Report

Special ReportTop 1000 Pension Funds 2024: Data

Skewed distribution of European pension fund assets