As inflation keeps beating records, real incomes remain under pressure and the standard approaches to diversification are challenged. In this context, reallocating within traditional asset classes and adding alternatives into the asset mix are two options to consider.

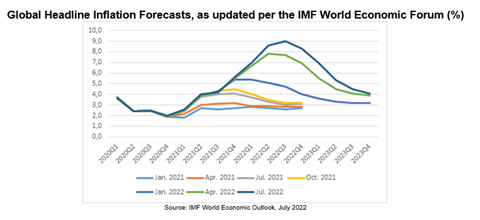

Growth downgrades and inflation upgrades have been the story of 2022, particularly in Western economies. While expected inflation is easy to hedge because asset prices reflect it, history shows that higher inflation also means higher inflation volatility.

The new paradigm is not an easy environment for investors to navigate, as listed stocks and bonds are now positively correlated for the first time in over a decade, which poses an issue for standard approaches to diversification.

Investors should be assessing their asset allocations to understand how they would fare in a more persistent inflationary environment, and more importantly in a period of volatile inflation prints.

It would be easy to dismiss inflation as ‘transitory’. However, this is a matter of perspective: an investor with a long-time horizon can probably view current consumer price inflation as transitory. Despite this, most people do not have this infinite horizon, and focus on shorter timeframes.

Even for investors that do not believe inflation will remain elevated for longer than expected, acknowledging that outcomes are uncertain means an assessment for the inflation-sensitivity of asset allocation is a good idea.

However, sustained inflation has not been a serious risk for developed economies for the past 30 years. Today, investors are in a very different macroeconomic world and market structure (i.e. the tech sector was nascent in the 80s), with no recent or relevant data to guide the repositioning of their portfolios, in particular in new asset classes or strategies.

There is no ‘one size fits all’ way to build resilient asset allocations but two valid options can be considered: reallocating within traditional asset classes and adding some alternatives into the asset mix.

Reallocating within traditional asset classes

This requires limiting duration risk as weak returns are observed for nominal bonds, which is unsurprising as rising inflation is associated with rising yields. This can be done by limiting exposure to fixed income securities until offered yields match or exceed inflation expectations and favouring inflation-linked bonds (ILB).

Indeed, even if there is no inflation surprise during the lifetime of an ILB, the security protects capital in real terms, though this comes protection comes at a cost.

Within equities, the current regime change requires investors to re-evaluate how they balance their portfolios in terms of style (value versus growth).

For the first time since the 2008 crisis, favouring stocks with a lower sensitivity to interest rates (typically ‘boring stocks’) carries importance along with deemphasising stocks which are expected to grow earnings significantly in the future, typically but not only technology stocks which are adversely sensitive to unexpected inflation.

In fact, value stocks have historically outperformed growth stocks during rate-hiking cycles. There is now an opportunity to be more balanced as many investors are under-allocated to value after a decade of underperformance.

Incorporating some inflation-proofing in portfolios implies diversifying and holding stocks with profits that are resilient amidst inflation, which consists of sectors typically defined as value. These include manufacturers, commodity producers and companies with pricing power.

Moving beyond sectors, selectively allocating to emerging markets warrants consideration. Despite growth and policy challenges, emerging market (EM) assets currently benefit from favourable valuations and factor exposures, with these markets largely being commodity exporters, especially in Latin America.

Adding alternatives to the asset mix

Trend following strategies (CTAs) can be particularly useful, providing access to a diversified range of assets classes and systematically taking both long and short positions, based on momentum signals.

This results in an investment strategy capable of generation returns in both bearish and bullish market conditions if trends present. The ability of a CTA fund to outperform the inflationary environment can notably be explained by the fact that inflation shocks are prolonged events.

Whilst a CTA may have benefited from long positions in the bond markets over the last 30 years, currently they tend to be long commodities and short government bonds – the ideal positioning for inflation-driven markets.

Taking both long and short positions across various asset classes allows a CTA to profit from both assets that are direct beneficiaries of rising interest rates and also those penalised by it.

Hard/real assets, where the investor has security over a physical asset, offer another solution. Such assets include commodities, infrastructure and non-traditional real estate and have varying degrees of inflation protection built in.

With a low correlation to traditional asset classes, a real assets allocation can also provide diversification and enhance risk-adjusted returns.

It is unclear whether we are on the cusp of a new inflationary era, which could see the forces behind inflation persist, however pretending inflation is not a real threat or not factoring in this possibility in portfolio positioning would be an error. At a minimum, there is enough uniqueness to the current macro enviroment to prepare for the worst, and hope for the best.