Anthony Harrington

Contact info

- Email:

- liam.kennedy@ipe.com

- Special Report

Private Markets: Changes in trends and attitudes

Anthony Harrington assesses the interaction between the supply of private market impact opportunities and investor attitudes towards them

- Special Report

Testing the value of diversified growth

Anthony Harrington finds managers keen to emphasise the robustness of the diversified growth concept following criticism from the likes of Willis Towers Watson

- Special Report

Settlement: A pan-European platform

Anthony Harrington looks at the introduction of the Europe-wide Target-2 Securities settlement engine for securities transactions

- Special Report

Securities lending squeezed

Anthony Harrington discusses the effects of the Basel III capital adequacy regulations on the securities lending business

- Special Report

High Yield: Beyond traditional metrics

There are no short cuts in the evaluation of high-yield opportunities, according to Anthony Harrington

- Special Report

Leveraged Loans: An attractive niche

Leveraged loans and CLOs represent a niche that is increasingly interesting for European institutional investors and multi-asset credit funds

- Special Report

Catastrophe Risk: Earth, wind and diversification

Diversification across catastrophe risks between different territories and natural perils is essential, according to Anthony Harrington

- Special Report

Private Placements & Speciality Lines: Sound private arrangements

Diversifying into aviation, marine and energy risks through private placements makes sense from a risk-and-return perspective, writes Anthony Harrington

- Asset Class Reports

Mid-caps: Time to take the middle road

Offering better outperformance than large-caps and more robust than small-caps, mid-caps are particularly attractive

- Special Report

Outlook 2016: Weighing currency’s value

Currency movements are capable of wrong-footing even the experts. Yet many argue that there are enough predictable patterns to these movements to make currency a valuable asset class

- Special Report

Securities Services: Tougher times for providers

Securities services providers are having to raise their game in response to demands of clients who face both increasing regulatory pressures and a low-yield environment

- Special Report

Beyond Excel spreadsheets

Pension funds are increasingly turning to custodians for help in dealing with the complexities of investing in illiquid alternatives asset classes

- Special Report

Euro-zone recovery: Insurance and repression

European insurers are finding ways to adapt to the prolonged period of low interest rates and unconventional monetary policy

- Asset Class Reports

High Yield: US issuers, euro spreads

A substantial spread differential is attracting US investment-grade issuers across the ocean to issue bonds in euros

Special Report

Special ReportSmart beta performance: Proving their worth

Real-market performance of three of the leading equity smart beta strategies shows these approaches have something worthwhile to offer

Special Report

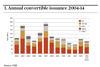

Special ReportSpecial Report, The M&A Cycle: Turning the ratchet

Convertible bonds are not only a good way for fixed-income investors to protect themselves against the ravages of M&A. Martin Steward and Anthony Harrington find that they are a great risk-managed way to exploit the cycle, too

- Features

Special Report – Outlook 2015: Taxing times for investors

A crackdown on multinational tax avoidance could have significant impact on corporate strategy and portfolio investment theses, writes Anthony Harrington

- Features

ECB exercise to beef up ABS

The ECB hopes its plans to invest heavily in the asset-backed securitisation market will encourage other investors and ultimately help boost real economy lending, writes Anthony Harrington

- Special Report

Africa: Could Africa feed the world?

Anthony Harrington asks whether the inextricable links between agriculture and infrastructure will constrain or unleash investment in Africa’s food-production potential