All IPE articles in April 2019 (Magazine) – Page 2

-

Features

FeaturesESG: Code could boost engagement

Loopholes in the revised Stewardship Code under consultation in the UK may mean it fails to realise its full potential for raising engagement with investee companies.

-

Asset Class Reports

Asset Class ReportsBrexit: Deal or no deal

Brexit uncertainties are making stockpicking a difficult task

-

Features

FeaturesBriefing: Emerging markets fail to catch up

Emerging markets have failed to increase their share of global investible market capitalisation since 2007

-

Features

FeaturesPLSA Conference: On the brink of cost transparency

Trustees, consultants and other pension professionals gathered in Edinburgh in early March for the annual investment conference of the Pensions and Lifetime Savings Association (PLSA).

-

Interviews

InterviewsCheyne Capital Management: High-impact debt investor

The growth of non-bank lending in Europe is often mentioned as a trend that could radically transform the European economy. This remains to be seen, but if banks gradually give some of their dominance in the lending market, then firms such as Cheyne Capital Management stand to benefit.

-

Country Report

Pensionskassen facing challenges

The number of insurance-based pension funds on the supervisor’s watchlist is falling. But some providers are in serious trouble

-

Features

FeaturesPension fund consolidators enjoy strong growth

Efforts to increase scale and improve efficiencies across the European pension fund sector are gathering pace, new data shows – but schemes still face hurdles

-

Features

FeaturesFixed income, rates, currencies: Markets take nervous turn

The reaction and aftermath to the US Federal Reserve’s dovish pivot appears to be more focused on the monetary policy news itself and the ‘fuel’ of easy money.

-

Special Report

Special ReportWays to improve DC pensions

International policy best practice holds lessons for UK defined contribution pensions

-

Interviews

On the record: Delivering on our promise

Dmytro Sheludchenko of Sweden’s AP1 buffer fund explains how it constructs and manages its factor-investing portfolios

-

Features

FeaturesDeviate at your own risk

The recent controversy about factor investing has probably not caused any distress to the investment industry, let alone the wider public, but it is a fundamental one

-

Special Report

Special ReportESG: The missing dimension in risk management

Embedding ESG into the investment process will be in the long-term financial best interest of beneficiaries

-

Special Report

Special ReportMulti-factor ETFs: A recipe only as good as its ingredients

The performance of multi-factor ETF strategies reflect the choice of factors as well as portfolio construction

-

Country Report

Country ReportVBV: Exciting possibilities

Günther Schiendl, CIO of VBV, Austria’s largest pension fund, talks to Barbara Ottawa about the importance of illiquidity and the EU’s sustainable finance initiative

-

Special Report

Special ReportFactor investing: The paradox of low volatility

Despite scepticism by some investors, low-volatility investing does appear to work, especially during market downturns

-

Special Report

Special ReportStrategy: Factor rotation hits record pace

Tilting between factors could work well in this environment

-

Special Report

Five key trends shaping manager selection

We asked consultants how the job of choosing asset managers is changing

-

Country Report

Country ReportPensionsfonds flourish

Several trends have converged to bolster the popularity of Pensionsfonds

-

Asset Class Reports

Asset Class ReportsInnovation is key for pharma

Europe’s pharmaceuticals sector must be innovative to stay ahead of global rivals

-

Special Report

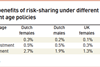

Special ReportManaging macro-longevity risk

An internal market for macro-longevity risk could provide an alternative to hedging tools

- Previous Page

- Page1

- Page2

- Page3

- Next Page