All IPE articles in April 2021 (Magazine)

View all stories from this issue.

-

Features

FeaturesPerspective: UK actuaries and COVID-19 – Exceeding expectations

COVID-19 has brought few positive outcomes but the response from UK actuaries could become a template for bringing other strategic challenges to the fore

-

Country Report

Country ReportCountry report – Pensions in Germany (March 2021)

Social partner pensions are just one of the new defined contribution (DC) pension arrangements which have emerged in Germany in the past three year and more more could follow, as we analyse in this report. Will this bring a boost to the country’s neglected second pillar? We also look at pension risk management and find how investors are evolving to adapt to new realities in terms of assets and liabilities, and assess why German politicians are looking abroad for ways to boost exposure to equities in long-term savings.

-

-

-

Features

FeaturesIPE Quest Expectations Indicator - April 2021

COVID-19 vaccination figures are rapidly increasing in Europe despite supply problems. Vaccinations are still restricted to vulnerable groups in many countries although the UK is a notable exception. Some countries have imposed new lockdown measures.

-

Special Report

Special ReportAP3’s partnership approach

Claudia Stanghellini, head of external management at Tredje AP-fonden (AP3), talks about the fund’s strategy when selecting managers

-

Features

FeaturesLong term assets: Proposed vehicle aims to help DC funds access private asset classes

The UK’s chancellor of the exchequer, Rishi Sunak, has set an ambitious timetable for the launch of a new UK-authorised fund vehicle, the Long-Term Asset Fund (LTAF), by the end of 2021. The LTAF is envisaged to simultaneously help achieve several policy goals by directing pension savings into alternative investments.

-

Features

FeaturesDB accounting: Lump-sum benefits

Service-defined lump-sum payments are causing accounting attribution problems

-

Features

FeaturesAhead of the curve: Modelling the unmodellable

In January 2020, the world was on the verge of a pandemic. It would empower the state, increase the might of technology firms, speed up technological adaptation, upend cities and accelerate China’s rise.

-

Interviews

InterviewsStrategically speaking: Allianz Global Investors

Allianz Global Investors (AGI) has long invested in green infrastructure. The market, and the perception of renewable energy for investors in particular, has changed during this time. Investors are ready to engage with renewable energy or cleantech if the underlying technology has a proven track record.

-

Opinion Pieces

Opinion PiecesGreen ambitions to drive recovery

Last month, Italy announced its first foray into the hot market of green bonds by raising a record €8.5bn (see page 9).

-

Asset Class Reports

Asset Class ReportsAsset class report – Fixed income & credit

As the world still grapples with the implications of the COVID-19 pandemic, credit investors continue their search for attractive yields in an environment where liquidity, even for long-term investors, could become critical. In this report, we look at different aspects of the fixed income & credit universe, including multi-asset credit strategies, the changing US high yield market, and the opportunities for institutional investors in trade and supply-chain finance.

-

Opinion Pieces

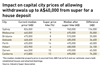

Opinion PiecesLetter from Australia: Should super savings fund homes?

A post-COVID-19 housing boom has made the future of Australia’s A$3trn (€2trn) superannuation savings pool a hot topic.

-

Country Report

Country ReportAustria: Sustainable growth remains elusive

Austrian providers are calling for solutions to make occupational pensions more appealing in light of demographic pressures and COVID-19 fallout

-

Opinion Pieces

Opinion PiecesLetter from US: Pension bonds raise concerns

The resurgence of interest in pension obligation bonds (POBs) is one of the effects of the pandemic on the US pension funds industry. Indeed in 2020 POB issuance reached its highest level in a decade, exceeding $6bn (€5bn), according to Municipal Market Analytics (MMA), an independent research firm focusing on the US municipal bonds.

-

Country Report

Country ReportPension Risk Management: Dealing with a challenging year

German pension investors are evolving to adapt to new realities in terms of assets and liabilities

-

Asset Class Reports

Asset Class ReportsUS high yield: A changing market

US high yield looks attractive against investment-grade credit although there are important changes for key sectors

-

Opinion Pieces

Opinion PiecesHopes for coherence in sustainability disclosures regulations

It could have been done differently, but, nonetheless, a clear path is emerging as to how EU sustainable finance regulations will become more of a coherent whole. The problem that has been perceived and outlined time and time again by investor groups is that disclosures are being asked of their constituencies – asset managers, pension funds – for which the data is not really available, or only at a significant cost. Tough, some may say, get on with it.

-

Interviews

InterviewsOn the record: Value makes a comeback

IPE asked two European institutional investors what biases are built in their equity portfolios, as value equities show signs of new-found strength

-

Features

FeaturesInflation strategy: Conditions look ripe for a new commodities supercycle

The media briefly got excited when the followers of Reddit – a social news website often used by political activists – ineffectually attempted to ramp up silver prices in February. But news about commodity prices other than oil and gold rarely make headlines. For most institutional investors, commodities are a Cinderella asset class. A fleeting moment in fashion before the 2008 global financial crisis (GFC) has been superseded by widespread indifference.