All IPE articles in February 2022 (Magazine) – Page 2

-

Features

Briefing – ESG data: material innovations

As environmental, social and governance (ESG) considerations have risen in importance among investors in recent years, so the subject of data quality has become an essential issue.

-

Special Report

Special ReportCase study: Readying PEPP for launch

The EU’s PEPP is like a shuttle aircraft, with the potential to carry individual savers across Europe. But its flight plan is detailed and complex, and admin providers play a key role in preparing PEPP for launch

-

Features

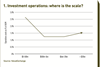

FeaturesResearch: Operational challenges for investors

A new study on operational and informational efficiency highlights the challenges for smaller funds

-

Opinion Pieces

Opinion PiecesLetter from US: Upcoming court ruling could create complications for DC plan sponsors

By the first half of this year, the United States Supreme Court is expected to issue a decision that could affect the defined-contribution (DC) industry. The case is Hughes vs Northwestern University, one of about 150 similar class-action lawsuits filed nationally in the past few years, alleging that plan fiduciaries breached their duty of prudence under ERISA, the Employee Retirement Income Security Act of 1974.

-

Features

FeaturesFixed income, rates, currencies: COVID starts to lose grip on GDP

COVID’s huge influence on all our lives, whether through disruption of global supply chains or threats of lockdowns in the face of soaring infection rates, was reasonably constant throughout 2021. However, it now appears that GDP numbers have become generally less sensitive to COVID infection rates than they were, say, 18 months ago, with high vaccination rates (certainly across developed markets), and an awareness from politicians that the public’s willingness to comply with lockdowns may be waning fast.

-

Opinion Pieces

Notes from the Nordics: Danish funds keen to invest in green project

Danish pension funds have been at the forefront of discussions on how to achieve the nation’s ambitious goal to reduce greenhouse gas emissions by 70% from 1990 levels by 2030.

-

Features

FeaturesPerspective: La dolce pensione

Italy may be on the verge of overhauling its pension system, but there are signs the reform project lacks ambition

-

Country Report

Country ReportFunding levels down, but outlook good

An update on the accounting deficits in Irish DB pension schemes

-

Asset Class Reports

Asset Class ReportsPortfolio Strategy - Hedge Funds: Juggling the ESG imperative

ESG has the power to transform, but do hedge funds have the drive, data and determination to fit sustainability into their investment process?

-

Opinion Pieces

Opinion PiecesThe EU taxonomy needs rescuing

The EU taxonomy, a system for identifying what economic activities count as sustainable, has been in the spotlight since the news broke on new year’s eve about a proposal from the European Commission to extend it to cover nuclear energy and natural gas. It is unclear how long the controversy will last.

-

Features

FeaturesStrategically speaking: Eyes on the next frontier

“Riddle me this,” asks Yves Choueifaty, founder, president and CIO of French asset manager TOBAM. “Why would 70 people who are not TOBAM employees be at our Paris headquarters today?”

-

Special Report

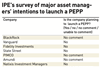

Special ReportPEPP: Few players on the starting line

In March, the European Union’s Pan-European Personal Pension Product (PEPP) framework comes into effect, amid doubts about the take-up by providers

-

Special Report

Special ReportThe jury is still out on PEPP: industry views

IPE asked some of the leading voices in the European pension industry to comment on the likelihood of success for the PEPP

-

Special Report

Special ReportSpecial Report – Pan-European Personal Pensions

From March, the European Commission’s vision of a simple, cross-border savings product becomes a reality with the launch of the Pan-European Personal Pension Product (PEPP). EU citizens will for the first time be able to channel savings into a long-term third-pillar product that is cost effective, simple and portable across borders.

- Previous Page

- Page1

- Page2

- Next Page