High Yield Bonds – Page 2

-

Features

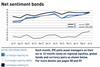

FeaturesIPE Quest Expectations Indicator - January 2025: hard to pick short-term winners

IPE’s latest manager expectations survey finds high net sentiment across most main asset classes as allocators weigh the Trump trade

-

News

NewsAssociations back credit ratings in EU post-trade transparency framework

BVI, AFME, bwf, EFAMA and ICMA are asking for a distinction between investment-grade and high-yield corporate bonds

-

Features

FeaturesIPE Quest Expectations Indicator - December 2024

Bond expectations falling, equity mostly flat

-

Features

FeaturesFixed income, rates, currencies: All eyes on Trump’s return

With the Republican Party now in control of both Senate and House, the leeway that President-elect Donald Trump will have to enact his pre-election policies could be considerable.

-

Opinion Pieces

Opinion PiecesPreparedness: a new asset class?

Wars are famously costly. Most people would agree that preventing them is infinitely preferable to paying for them.

-

Features

FeaturesIPE Quest Expectations Indicator - November 2024

Donald Trump has profited from climate change, which he believes unimportant, as this year’s hurricane season has so far seen more storms over a wider area.

-

Features

FeaturesSoft landing likely again for US economy

It has been more than a year since the attacks by Hamas in Israel and tensions in the Middle East remain high, with a rising impact on financial market sentiment.

-

Features

FeaturesIPE Quest Expectations Indicator - October 2024

In generic US polls, Democrats beat Republicans, with a small but increasing margin, signalling an opportunity for reforms if Kamala Harris wins and a continuation of a divided and blocked Congress if Donald Trump wins.

-

Features

FeaturesFixed income, rates, currencies: All eyes are on US elections

With so many important elections taking place this year, politics were likely to have an outsized influence on financial markets.

-

Features

FeaturesUS high yield bonds punch out of a corner

US high yield has come a long way from its murky beginnings with the very high yielding bonds of so called ‘fallen angels’, and Drexel Burnham Lambert’s Michael Milken offering bonds newly issued by corporates with sub-investment grade ratings for the first time in the 1980s, properly introducing the world to high yield bond investing.

-

Special Report

Special ReportTop 10 European pension funds raise equity and bond exposure

Pension funds in most European countries recorded strong returns of between 6% and 9%, according to preliminary figures published this summer by the OECD.

-

Features

FeaturesIPE Quest Expectations Indicator - September 2024

Kamala Harris’ candidacy has turned the political mood in the US. The two candidates are very close together in the polls but while Trump’s score is stable – except for a worsening favourability – Harris’ statistics all show a positive trend.

-

Features

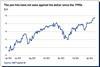

FeaturesIPE Quest Expectations Indicator - August 2024

Joe Biden’s weakness was a lucky stroke for Donald Trump, who has shown similar symptoms for years. It remains to be seen what effect Kamala Harris has on the polls. Trump and his chosen VP are both proponents of weakening the USD.

-

News

NewsSwiss occupational scheme tenders up to CHF1.2bn in bond mandates

The searches are for emerging market debt and US high yield bonds, considering both active and passive options

-

Features

FeaturesMarket predicts US soft landing - June 2024

A combination of Federal Reserve chair Jerome Powell’s press conference and a slightly weaker-than-expected US April non-farm payrolls outcome succeeded in flipping the market back to a soft-landing narrative for the US economy. US Treasury bonds rallied sharply, taking other markets with them, while the yen weakened significantly against the dollar before recovering.

-

Features

FeaturesIPE Quest Expectations Indicator - June 2024

Trump and Biden are both losing to undecided voters, a group that is now unusually large and may be sensitive to Trump’s legal troubles. Biden’s approval rate is below his score in presidential polls, while Trump’s score is the same in presidential polls and those measuring voters’ opinion of him. In the UK, the Conservatives took another drubbing in the local elections.

-

Features

FeaturesIPE Quest Expectations Indicator - May 2024

EU parliamentary elections are approaching fast. Current polls predict a shift to the right, with the current centrist parties remaining dominant and the extremist right overtaking the Eurosceptics. US President Donald Trump is still liable to be convicted in a criminal case, but his poll figures are rising.

-

Features

FeaturesUS economy continues to surprise

The resilience of the US economy continues to confound observers. The Federal Reserve’s 11 hikes in interest rates over the course of 2022 and 2023 were implemented to rein in economic strength and to stifle inflation. Scroll forward to the second quarter of 2024 and both inflation and economic activity are still higher than expected.

-

Asset Class Reports

Asset Class ReportsFixed income: European high yield stands its ground

Investors flocked to the European junk bond market last year and despite a strong US economy, there is still appetite for European issuers

-

Opinion Pieces

Opinion PiecesATP at 60: no plans to retire the guaranteed pensions model

Now approaching retirement age itself, Danish statutory pension fund ATP is using its 60th birthday as an opportunity to reinforce the validity of its guarantee-based investment model.