High Yield Bonds – Page 3

-

Features

FeaturesReluctance to drop interest rates disappoints the markets

US rates markets entered the year enthusiastically pricing in over 160 basis points of cuts through 2024, and have since had to push back hard on both the timing and magnitude of interest rate cuts now expected by year-end.

-

Features

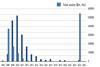

FeaturesA bumper year for convertible bond issuance

The convertible bond market ended 2023 on a strong note with its main index – the Refinitiv Global Focus – returning 6% in the fourth quarter. The optimism has continued into 2024 on the back of reasonable valuations, historically low equity volatility and better opportunites.

-

Interviews

InterviewsMuzinich’s Tatjana Greil Castro on credit fundamentals

In one of the meeting rooms of the London office of Muzinich & Co are displayed a series of bond certificates from the past.

-

Features

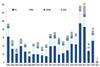

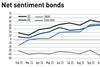

FeaturesIPE Quest Expectations Indicator - February 2024

IPE’s monthly poll of market sentiment, asking 50 asset managers about their six to 12-month views on regional equities, global bonds and currency pairs

-

Features

FeaturesIPE Quest Expectations Indicator - January 2024

It is safe to predict that 2024 will be a year of desperate campaigning. Political surprises in the US and UK are possible and, this time, they do make a difference to markets

-

Features

FeaturesWill delayed economic bad news hit the market this year?

Global economic growth was below potential in 2023, but still markedly stronger than the forecasts had been indicating at the start of the year, with the US leading the way and even the likes of Europe and the UK, though hardly stellar performers, posting better than expected economic activity.

-

Interviews

InterviewsBarings: A bond investor for changing times

Martin Horne is the new global head of public assets at Barings bond investor, but he is a bond guy through and through.

-

Asset Class Reports

Asset Class ReportsFixed income: Investors put weight behind bond markets

Exposure to bonds is rising at the fastest rate since the financial crisis, as investors focus on high-quality paper and the shorter end of the yield curve

-

Asset Class Reports

Asset Class ReportsDebt investors face European uncertainty

High interest rates and inflation are the biggest concerns as recession looms

-

Features

FeaturesIPE Quest Expectations Indicator - December 2023

IPE’s monthly poll of market sentiment, asking 50 asset managers about their six to 12-month views on regional equities, global bonds and currency pairs

-

News

NewsPublica tenders €2bn in corporate bonds mandates via IPE Quest

Tender is for two passive or enhanced passive corporate bond mandates – one for European and the other for US bonds

-

Features

FeaturesIPE Quest Expectations Indicator - November 2023

IPE’s monthly poll of market sentiment, asking 50 asset managers about their six to 12-month views on regional equities, global bonds and currency pairs

-

Features

FeaturesIPE Quest Expectations Indicator: September 2023

US officials are talking up the Ukrainian advance towards Melitopol, a sign that all is not well. Contrary to expectations, the biggest problem is not the Russian air force, but land mines. Trump’s legal problems are as worrisome as his inexplicable lead among Republicans. US abstinence in the struggle against climate change is a potential cause for a major trade war as the EU realises it must expand its regulations on importing ‘dirty’ products to prevent a free rider problem undermining its climate efforts. In the UK, Labour’s lead over the Conservatives remains crushing, making it difficult to claim the government has a popular mandate.

-

Features

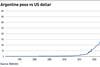

FeaturesFixed income, rates & currency: Uncertainty persists

As the major central banks in developed markets reach, or at least near, the end of their hiking cycles, markets, rather than identifying when policy rates will peak, focus is now on the conundrum of just how long these policy peaks will be maintained.

-

-

Features

FeaturesIPE Quest Expectations Indicator: August 2023

Politics is on hold until September. Normally, markets do not care and analysts reduce their activity. A political crisis in the Netherlands shows the danger. There are warnings from all sides that climate measures are ever more urgently needed. Markets need a clearer view of which products govern- ments will support with market-shaping measures and when, especially in the face of a faltering pace towards climate goals. Early signs of problems include a lack of capital for innovative start-ups and the increasingly loud voices of climate change deniers.

-

News

NewsMandate roundup: Swiss pension fund tenders investment grade mandate

Plus: Swedish Fund Selection Agency hands mandate to Style Analytics

-

Features

FeaturesIPE Quest Expectations Indicator: June 2023

Continued loud bickering between the Wagner Group and the Russian army is protecting Putin from both, worsening the outlook for peace, while there are multiple signs that military supplies are approaching exhaustion. The coalition supporting Ukraine is stronger than ever, showing increasing willingness to provide military aircraft. Yet the offensive expected in February has not started. In the US, Florida governor Ron DeSantis is damaging his position with an unproductive row with Disney, while Trump has moved closer to a prison term. Gas consumption in the EU is falling faster than expected, due to efficiencies like heat pumps, changeover to electricity and solar panels. Macron scored nicely by sponsoring the participation of Zelensky at the Hiroshima G7; Sunak failed to centre political attention on China.

-

Special Report

Special ReportOutlook – Europe and the world: CIOs focus on bonds and quality stocks

With the prospect of weaker growth, volatility and higher inflation and rates, strategists argue for more selectivity in investments

-

Features

FeaturesFixed income, rates & currency: Strong labour markets surprise

Global purchasing managers’ index (PMI) data, which measures the state of the US economy, has been mostly strong, although manufacturing indices have been considerably weaker than services, perhaps reflecting their greater sensitivity to higher interest rates.