High Yield Bonds – Page 5

-

Features

FeaturesFixed income, rates, currencies: Inflation spotlight on central banks

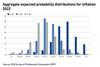

Not often far from the action, central banks have been centre stage in 2022 as one after another in the developed markets reveal their hawkish intents. The speed and synchronicity with which they have shifted has been pretty remarkable, with only the Bank of Japan not yet joining other main central banks.

-

Features

FeaturesBriefing: High yield off to a rough start to the year

High yield did not have a good start to the year. Rising inflation and a more hawkish central bank tone in the US and UK triggered panic selling in January. However, as the dust settles and bad news is priced in, the asset class looks more appealing than other fixed-income segments. Easy pickings may be gone, though, and opportunities will have to be selected carefully.

-

Asset Class Reports

Asset Class ReportsUS banks lead a boom in debt issuance

Capital requirements and locking in cheap funding have prompted banks to issue more bonds, but Europe lags behind

-

Special Report

Special ReportNextGenEU: Towards a new euro yield curve?

Bonds designed to support member states hit hardest by the pandemic look set to become a new safe asset

-

News

ATP ditches €800m US HY exposure to buy €1bn green corporate bonds

Danish pensions giant says shift to green bonds within investment portfolio is part of future-proofing efforts

-

News

LD Pensions tenders €235m systematic HY bond mandate

Danish pensions manager sets 15 September deadline for bids to deliver long-only, systematic high-yield strategy

-

News

AP1 says fund launch marks strategy shift to net-zero from fossil-free

Swedish buffer fund seeds jointly-developed Federated Hermes climate impact HY fund

-

Features

FeaturesIPE Quest Expectations Indicator - August 2021

The next wave of COVID-19 has come to pass earlier than expected, largely due to new variants. The UK is hard hit, being sensitive to variants Alpha, Beta and Delta. The EU is next in line, with the Netherlands, Spain and Denmark in the forefront and Delta playing a leading role, but other member states are right behind. There is no sign of the next wave in the US yet, but it is sensitive to the variants Gamma and possibly Alpha, which plays a role in Canada.

-

News

NewsPension fund in Denmark tenders $100m corporate bond mandate

Plus: Discovery search for residential real estate

-

Features

Pensions insider: Handling mistrust after a huge loss

In the first in a series of articles aimed at empowering trustees, our expert contributor describes how a pension fund solved a real-life case involving poor judgement by a high-yield bond manager

-

News

Ilmarinen invests €170m in AXA low-carbon HY bond fund

Finnish pension insurer is seed investor in active ESG fixed income fund, which is ‘one of the first of its kind’

-

Asset Class Reports

Asset Class ReportsUS high yield: A changing market

US high yield looks attractive against investment-grade credit although there are important changes for key sectors

-

Features

FeaturesFixed Income, Rates, Currencies: A very different recovery

Amongst the remarkable happenings in 2020, from startling news of a pandemic to viable vaccine and beyond, has been the speed and scale of interventions from central banks and governments.

-

Opinion Pieces

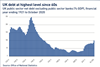

Opinion PiecesViewpoint: The tipping point for UK pension schemes

Schemes need to consider how to get to a secure level of funding, but also, the assets they will need to hold when they reach peak cashflows in order to remain fully funded

-

News

Commission to use rescue plan to create ‘European yield curve’

‘In addition to issuing bonds with a maturity of up to 30 years, there will also be an emphasis on the short end’

-

News

AP1 spurs more fossil-free funds as TOBAM adapts EM, HY

Swedish state pension buffer fund says initiative is a milestone

-

News

Intesa Sanpaolo issues €1bn in equity, bond mandates

The scheme is seeking managers for US and euro corporate bonds, global high yield corporate bonds, among others

-

News

WTW: Passive managers ‘disappoint’ as stewards of fixed income

Stewardship in fixed income is a position of significant influence, says consultancy

-

News

NewsBrunel PP seeks managers for £1.5bn MAC, £1.2bn corporate bond funds

The MAC portfolio will invest in high yield corporate bonds, bank loans, asset-backed securities and emerging market debt

-

News

NewsLarge cap value, global HY mandates put out to tender via IPE Quest

Scandi pension fund and UK-based institutional investor are behind the searches