All IPE articles in January 2020 (Magazine) – Page 2

-

Interviews

InterviewsInterview: Miranda Carr, Haitong International

It is all too easy to forget that the markets are in a peculiar state. For example, nominal yields on US 10-year Treasuries have trended downwards since 1981. Real interest rates – that is, adjusted for inflation – have also trended downwards from about the same time. Estimates vary but there are also many trillions of euros worth of negative yielding debt.

-

Features

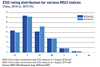

FeaturesChina: On a long climb up the ESG ladder

China is the world’s biggest emitter of greenhouse gases, compels imprisoned Muslims in Xinjiang to toil in factories, and has Communist Party committees embedded in companies, exercising a shadowy influence over management. It is, in other words, not exactly a poster child for good ESG performance.

-

Opinion Pieces

Opinion PiecesLetter From US: Concerns over common ownership unabated

No matter who wins the presidential election this November the issue of concentration of US corporate ownership by the Big Three money managers – BlackRock, Vanguard and SSGA – will not go away

-

Features

FeaturesPensions depositaries: IORP II’s new consolidation option

European pensions legislation raises the possibility of a new kind of consolidation vehicle that could also accommodate large Dutch mandatory industry-wide pension funds

-

Opinion Pieces

Opinion PiecesGuest Viewpoint: Fabrice Demarigny, Joachim Nagel & Corien Wortmann-Kool

“A reboot of the CMU has moved up the European policy agenda”

-

Asset Class Reports

Asset Class ReportsUS investment grade: A year for not living dangerously

Geopolitical uncertainties are pushing investors away from longer-term strategies

-

Analysis

AnalysisInvestors react to EU Green Deal

PensionsEurope and EFAMA have reacted positively to a European Commission climate change-driven growth strategy

-

Features

FeaturesHow to improve EIOPA’s stress test

EIOPA’s 2019 stress tests already included substantial improvements, but the cash flow analysis could be improved further

-

Asset Class Reports

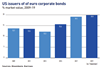

Asset Class ReportsFixed Income – European investment grade: No sign of end for negative yields

Negative interest rates look set for a lengthy run in Europe, raising concerns about the long-term effects

-

Features

FeaturesESG Report: SAAving the world?

Integrating ESG has become commonplace in institutional investment, but generally the discussion has focused on areas such as security selection and stewardship

-

Country Report

Country ReportEstonia: Reforms face opposition

Proposals designed to strengthen the Estonian first pillar are proving controversial

-

Opinion Pieces

Opinion PiecesGDP numbers spread fake news

GDP is a measure of economic activity rather than wealth creation. As such, it can give misleading signals about the health of an economy

-

Interviews

InterviewsHow we run our money: Xerox UK Final Salary Pension Scheme

Jeffrey McMahon, head of pension investment and risk at Xerox UK, tells Carlo Svaluto Moreolo about the plan to make the company’s legacy DB scheme self-sufficient

-

Special Report

Special ReportPEPP: Time to get personal

Can the new Pan-European Personal Pension Product close Europe’s pensions gap?

-

Opinion Pieces

Opinion PiecesTime for a positive impact on investing

The focus on sustainability and impact investing is expected to continue to grow, with potential regulatory and policy responses having wide-ranging investment implications

-

Interviews

InterviewsOn the Record: Retirement income

IPE asked three pension funds how they help members to ensure investment returns are turned into good retirement outcomes

-

Opinion Pieces

Opinion PiecesSystemic risk may be underestimated

Underestimating the scale of systemic risk within the asset management industry is a mistake. For several years, macroprudential authorities including the International Monetary Fund, the European Central Bank and the Bank of England have argued that asset management activities are becoming systemically more risky.

-

Interviews

InterviewsStrategically speaking: QMA

QMA’s CEO Andrew Dyson explains why current market dislocations arguably represent the biggest investment opportunities of the last decade – if not of the last 25 years – for value investors

-

Country Report

Country ReportRomania: Still under threat

Political decisions have damaged Romania’s second-pillar system. How will it respond to a change of government and a bullish stock exchange?

- Previous Page

- Page1

- Page2

- Next Page