Latest from IPE Magazine – Page 123

-

Country Report

Country ReportDB funding: Funding woes continue

Volatile financial markets and legislative uncertainty continue to cause headaches

-

Features

FeaturesThe proof of the Brexit pudding is in the eating

Brexit “got done”, to paraphrase the British prime minister, at the end of January. But the exact form it will take is still to be determined

-

Analysis

AnalysisBlackRock goes big on climate risk

BlackRock announced last month it would be placing sustainability at the centre of its investment approach, and a host of measures to go with that.

-

Analysis

AnalysisEFRAG: Reaching a compromise

It is hard not to feel some sympathy for the technical staff working on the European Financial Reporting Advisory Group’s pensions research project

-

Interviews

InterviewsOn the Record: Absolute return strategies

IPE asked two European pension funds how they invest in absolute return strategies, with a focus on hedge funds

-

Features

FeaturesESG: Standards specialists tackle sustainable finance

When it comes to language the world of ESG can feel a mess. Different terms are often applied inconsistently and often interchangeably to various approaches.

-

Interviews

InterviewsStrategically Speaking: Aspect Capital

Over the last few years, Aspect’s diversification strategy has involved generating alternative income streams from new programmes and reducing the cost base

-

Interviews

InterviewsHow we run our money: Cometa

Maurizio Agazzi and Oreste Gallo of Cometa, one of Italy’s largest pension funds, talk to Carlo Svaluto Moreolo about the fund’s evolving strategy

-

Opinion Pieces

Opinion PiecesGuest Viewpoint: Ric van Weelden

Asset owners have realised that diversity is more than just an ESG matter

-

Opinion Pieces

Opinion PiecesModi’s India: The red lights are flashing warnings

Under Prime Minister Narendra Modi, India is facing an existential issue that is polarising the nation

-

Opinion Pieces

Opinion PiecesPerspective: André Hoffmann – Green results, not greenbacks

Roche heir and pharmaceutical tycoon André Hoffmann outlines his view of a more sustainable model of capitalism

-

Opinion Pieces

Opinion PiecesLetter From US: New Secure Act – a step in the right direction

New rules encourage employers to offer annuities in 401(k)-type retirement plans

-

Features

FeaturesClimate change and AI set to transform investing

As the new decade begins, it is becoming clear that climate change and artificial intelligence will reshape the future of investing

-

Features

FeaturesFixed income, rates, currencies: A confident start to the year

Undoubtedly a good year for financial assets, 2019 ended on a bright note with the broad, and relieved, consensus that the China/US trade conflict might be de-escalating

-

Features

FeaturesAhead of the Curve: Avoid the crowds in EMs

Emerging markets (EMs) look set to be the most important growth engine of the 2020s as their consumption levels rise and China follows a saw-toothed growth path towards the economic top spot. However, asset-allocators need to remove themselves from the malign legacy of the 2010s if they are to tap this growth.

-

-

-

Features

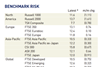

FeaturesIPE Quest Expectations Indicator: February 2020

Net bond sentiment is trending down, yet remains stable in Japan

-

Opinion Pieces

Beyond green ambitions

Europe has lofty ambitions as it positions the European Green Deal as Europe’s growth plan for the coming decade and beyond

-

Country Report

Country ReportPoland: Auto-enrolment off to a slow start

Disappointing take-up in first phase of auto-enrolment pension plan