Latest from IPE Magazine – Page 120

-

Opinion Pieces

Opinion PiecesLetter from US: The Democratic agenda takes shape

“On day one, [Joe] Biden will use the full authority of the executive branch to make progress and significantly reduce emissions. Biden recognises we must go further, faster and more aggressively than ever before, by (among other things) requiring public companies to disclose climate risks and the greenhouse gas emissions in their operations and supply chains.” That is Joe Biden’s ‘Plan for a Clean Energy Revolution and Environmental Justice’ as it appears on joebiden.com, the official campaign website.

-

Interviews

InterviewsUK auto enrolment: The architecture of a reform

The UK’s auto-enrolment policy has been successful. But this success has been no accident, as a new research project shows

-

Opinion Pieces

Opinion PiecesGuest Viewpoint: Steve Waygood

History may well look back on 2019 as the year the world finally woke up to the threats posed by climate change. Yet, with the negotiation failures that occurred at the 2019 United Nations Climate Change Conference in Madrid (COP25), the year ended on a significant downer.

-

News

Pensions Briefing: Incorporating ESG factors in pension investment activity

A look at IOPS supervisory guidance on the integration of ESG factors in the investment and risk management of pension funds

-

Features

FeaturesAhead of the Curve: The mega-cap conundrum

Last year was challenging for quantitative equity strategies with a large proportion of them underperforming their benchmark on a rolling one-year basis. There has, therefore, been a great deal of interest in understanding the shortcomings of quantitative portfolios over the same calendar year.

-

-

-

Features

FeaturesIPE Quest Expectations Indicator: April 2020

This months’ figures were collected before the successive stock-market slumps.

-

Features

FeaturesFixed income, rates, currencies: Global economy under pressure

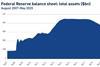

At the end of February, after a week that saw stock markets around the world plummet, US Federal Reserve chair Jerome Powell sought to calm fears, saying that the Fed would “act as appropriate” to support growth.

-

Opinion Pieces

Easier to abolish than to reform

The collective pension plan in its various iterations is probably one of the most significant, and undersung, financial and policy innovations of the 20th century. Workplace pensions represent one of the most important, if not the most important financial assets for millions of people.

-

Interviews

InterviewsOn the record: Asset manager selection

IPE asked the Caisse de prévoyance de l’État de Genève (CPEG) how manager selection is changing

-

Country Report

Country ReportNetherlands: Still searching for yields

Dutch pension funds are looking towards illiquid assets as they search for returns in the challenging low-interest-rate environment

-

Special Report

Manager Selection: A new guide to the future

Past performance is an unreliable guide to future success. Might the corporate culture of asset managers offer better foresight?

-

Special Report

Special ReportRegulation: Asset managers - Regulators set sights on liquidity

Concerns about systemic risk and fund liquidity are driving the regulatory agenda

-

Analysis

AnalysisEquities – Innovation frenzy in race for survival

Companies must cope with today’s unprecedented pace of technological disruption and rapidly evolving consumer expectations to stay in business

-

Opinion Pieces

Opinion PiecesJudgement needed more than ever

There are good reasons why even the most ardent technophile should be wary of the excitement surrounding new investment-related technology. Big data, artificial intelligence, machine learning and blockchain all no doubt have promising applications in the investment world.

-

Country Report

Country ReportNetherlands: A sector holding its collective breath

A tripartite steering group involving experts, stakeholders and government is trying to come up with a new concept for pension plans

-

Special Report

Special ReportManager selection: When delivering value becomes law

The debate around the value added by asset managers is taking fundamental steps forward

-

-

Opinion Pieces

Opinion PiecesEquities – European banks see light ahead

The European banking sector is moving into positive territory as the tough regulatory pressure of recent years levels off