Latest from IPE Magazine – Page 83

-

Special Report

Special ReportGiles Gunesekera: A gender view on climate

Women and girls are likely to suffer more from climate change

-

Special Report

Special ReportRaj Thamotheram: From urgency to agency

A recipe for change that can be enacted by positive mavericks

-

Asset Class Reports

Asset Class ReportsEmerging market debt report

Our opening article in this report looks at emerging market private credit. In EMs there is a $100bn corporate funding gap with 90% of lending through banks. But we find EMD managers broadly cautious overall, particularly on China, with interviews conducted before the Evergrande story broke. Lastly, we look at Latin America, where investors encounter populism and social unrest but sustainability bond issuance is booming.

-

Country Report

Country ReportCountry Report – Pensions in France (October 2021)

President Macron’s pension reforms were pretty much shredded by the pandemic. Asset managers and policymakers had been hoping that a successful reform programme would channel savings into supplementary pension vehicles like the FRPS. Instead, progress has been very slow indeed. We also profile the public sector scheme Ircantec and highlight Indefi’s latest research on the French institutional market.

-

Special Report

Special ReportInvesting in China

Investors the world over are thinking about China, from Soros to Mr and Ms Main Street. Our contribution to this theme (written before the Evergrande story broke) looks at both private and public equity, where managers are looking to align portfolios with China’s long-term investment needs. From a manager selection perspective, boots plus portfolio managers on the ground were an essential ingredient for successful portfolio positioning ahead of the July regulatory crackdown.

-

Country Report

Country ReportFRPS: Awaiting lift off

France’s new form of supplementary pension fund is only gaining traction slowly

-

Special Report

Special ReportPrivate equity: Focus shift brings turmoil to market

China’s focus on ‘common prosperity’ is boosting the importance of ESG factors and generating new opportunities as well as risks

-

Asset Class Reports

Asset Class ReportsThe next frontier for private credit

Global managers are making a strong case for investment in private credit issued by emerging market companies

-

Country Report

Country ReportIrcantec: High ESG ambitions

Ircantec’s latest four-year plan has a strong emphasis on social responsibility

-

Special Report

Special ReportCommon prosperity reshaping equity markets

China’s focus is shifting to emerging industries in its drive to become a powerhouse of innovation

-

Asset Class Reports

Asset Class ReportsAsset Allocation: Mixed prospects emerging

COVID and political risks may have affected EMs in different ways but there are still many opportunities in such a diverse asset class

-

Country Report

Country ReportResearch: The French experience

Outsourcing to third-party managers and the push towards defined contribution pensions were key themes in a year made difficult by the COVID-19 pandemic

-

Special Report

Special ReportQ&A: A manager selector’s perspective

IPE asked RisCura’s head of research, Faisal Rafi, for a perspective on the wider implications of recent events in China

-

Asset Class Reports

Asset Class ReportsEmerging Market Debt: Populism battles ESG in Latin America

Many policies championed by populist leaders in Latin America are in direct conflict with the ESG goals of global investors

-

Special Report

Special ReportCommentary: A mile in Xi’s shoes

The shift from ‘trade war’ to ‘tech war’ between China and the US has forced China’s policy makers to deal with the country’s three key vulnerabilities

-

Special Report

Special ReportInterview: Diana Choyleva

Diana Choyleva, chief economist at Enodo Economics, says the battle for technological supremacy between the US and China will transform the global investment map

-

Opinion Pieces

Opinion PiecesAn alternative pensions future

It’s no real news that ageing is changing our society in numerous ways – from simple things like product design (making smart phones for older eyes and fingers to use) to more generationally diverse workplaces.

-

Opinion Pieces

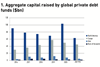

Opinion PiecesPension funds should seek fee reductions in private markets

Pension fund investment in non-listed assets has grown considerably since the 2008 global financial crisis.

-

Opinion Pieces

Opinion PiecesConsultants’ education role in net-zero world

Investment consultants play a crucial role within the savings and investments arena. They provide strategic advice to asset owners (pension funds, sovereign funds, endowments, insurers, and others) relating to strategy, asset allocation, asset manager selection and – now more importantly than ever – investment beliefs.

-

Features

FeaturesLong term matters: Vaccine apartheid and investors

This column last covered COVID-19 vaccine inequity in June. Since then, using The Economist’s model of “excess deaths”, there may have been more than 4m deaths globally. That means 37,700 people dying every day, arguably unnecessarily. This number comes with many caveats but it’s possible (indeed probable) that the figure could be much higher.