A recipe for change that can be enacted by positive mavericks

In my last article for IPE (Long term matters, October 2021), I suggested that asset owners should contact their asset managers about the climate emergency. I have since had inspiring conversations with several senior professionals.

The good news? When I co-founded Institutional Investors Group on Climate Change (IIGCC) in 2001 we were a tiny group. Today, the network is much bigger and these ideas come from some of the best-informed positive mavericks in this network. These six menus are like a cookbook – it is what you actually make that matters!

1. Rationalise the ESG ecosystem: there is absolutely a need for a ‘shakedown’ and more alignment but how this happens will have major real-world implications. The difference in worldviews between double materiality (GRI and the EU) and financial materiality (SASB, IFRS and many big managers) is major. As Carol Adams, professor of accounting at Durham University in the UK has explained, the space for creative alignment has now been lost. But European investors – and especially those that have a big footprint in the US – should strongly support a collaborate-and-learn scenario.

2. Prioritise neglected but important asset classes: fixed-income investors have escaped attention with the excuse that they do not vote and so stewardship is not relevant. This ignores their huge influence when they choose to roll over debt (or not). Credit investors are very important in the high-impact sectors (fossil-fuel suppliers, energy utilities) and must play a much greater stewardship role – credit-rating agencies too. This will not happen without much more assertive signals from asset owners and investment consultants. The same goes for private equity, which is set to play a big role in the oil and gas sector.

3. Push laggard fund managers on stewardship: asset owners and investment consultants have not thought hard or creatively about stewardship for decades. There is an urgent need to rediscover what ‘good’ means in this context of a systemic crisis (think universal ownership) and hold all managers accountable. Consultants and asset owners who are not well informed are easily brushed off with the slick greenwash that managers use while simultaneously supporting the status quo.

Asset owners should ask managers tough questions and get help from appropriately skilled consultants to interpret the responses. What is the full climate exposure of my portfolio (ie, carbon, physical and political risk)? If managers have not joined key collaborative engagement projects like CA100+, why not? The highly respected IEA has published a detailed 1.5°C scenario, which says no new fossil fuels from now. How in practice are managers changing their approach to reflect this?

“Positive mavericks in the investment profession are held back by the middle rump and especially the laggards”

What corrective action will those managers that are bottom quartile in the stewardship rankings of ShareAction or Majority Action take? The governance of sustainability at fund managers also needs scrutiny. Who is the sustainability competent board director? Is the chief ESG/sustainability officer part of the senior management team?

4. Leverage investment consultants: investment consultants in the UK have come a long way in terms of understanding sustainability in general and climate change in particular. The Investment Consultants Sustainability Working Group (ICSWG) includes all major UK consultants. But the good work of responsible investment specialists needs to be connected directly to fund researchers, to people setting strategies and, most importantly, to individual field consultants. These frontline consultants need to upskill. They should ask themselves whether they have had a substantive conversation on climate investing with all clients and, if not, why asset owners should ensure that a senior partner has ‘day job’ responsibility for the success of ICSWG. They should find out how firms evaluate themselves using the competency framework and encourage parallel projects in markets where consultants are important.

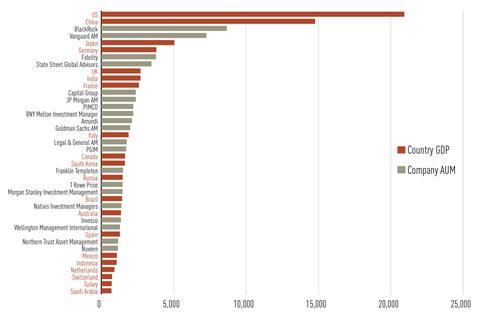

5. Focus on US financial sector players ‘today’: the US investment system is significantly behind Europe on climate risk. This is a big problem given the dominance of US corporate players at all key nodes in the finance ecosystem, including managers.

European funds that use US-headquartered managers should take a more assertive supply chain management approach by requiring all providers to meet best practice standards.

EU investors should also lead in lobbying North American regulators. US insurance players are clearly lagging their European peers. Voluntary initiatives will not address this problem, given board level conflicts of interests, so European asset owners should encourage US insurance regulators to act.

6. And use that learning with emerging markets ‘tomorrow’: the big medium-term challenge is China. EU investors can strengthen their stewardship muscles with the US but there is no time for a fully sequential strategy. One senior investment consultant says: “The only way to influence the Chinese is to invest there, which means a shorter-term increase in portfolio carbon intensity. This woud mean hoping that the public sector follows suit since they own most of the energy assets that are the biggest emitters.”

The CFA Institute surveyed c-suite contacts in 2020 and found “a relative lack of pressure coming from the external client base (regulators and investors) on climate change” and that “the climate risk message is still not gaining sufficient traction”. No fewer than 76% said the issue was somewhat or very important but 18% of North American respondents said it was somewhat or very unimportant (compared with only 1% of APAC and 14% of EMEA).

Top 20 countries vs investors AUM 2020

Humanity (polite reminder, this includes investors) has had the equivalent of a ‘terminal diagnosis’ wake-up call. The IPCC headlines were about reaching 1.1°C of the 1.5°C. But 2°C of warming is probably baked into the system because of the rate at which we’re cutting aerosols. The rate of warming in the next 25 years could double. Think of body temperature going from 37°C to 39°C. The severe weather events this summer aren’t the new normal. The rate of change is.

Some things that the survivors of a terminal diagnosis consider important include: cope with the distress; get clear on priorities; discover as much as possible about the condition; talk to specialists, not just your usual (medical) advisers; accept big risks (eg, major surgery, toxic drugs); and keep actively hoping for a miracle.

‘Positive mavericks’ in the investment profession are held back by the ‘middle rump’ and especially the ‘laggards’. The same goes for all the other professionals – legal advisers, credit rating analysts, insurance executives, auditors – who influence the transition. We have no idea about the positive synergies that may be possible if a critical mass of influential professionals show full ‘response-ability’.

And there are platforms these positive mavericks can use. The Glasgow Financial Alliance for Net Zero, a global coalition of leading financial institutions committed to a rapid decarbonisation, has commited to develop oil and gas policies in 2022-23 with Denmark and Costa Rica leading an inter-governmental Beyond Oil and Gas Alliance.

Actively hoping for a miracle on the climate crisis means things like this. The big uncertainty is what will each of us do.

Raj Thamotheram is a board member of The Shareholder Commons, a think tank focused on systemic threats to a just and sustainable economy

Topics

Towards Net Zero: COP26 and Beyond for Institutional Investors

The term Net Zero is becoming entrenched in political and business life as governments, banks, insurers, asset owners and, not least, corporates sign up to demanding pledges to reduce carbon emissions in the service of limiting global temperature rises to within 1.5C. Our extensive Special Report looks at Net Zero ...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

Currently

reading

Currently

reading

Raj Thamotheram: From urgency to agency