Latest from IPE Magazine – Page 96

-

Features

FeaturesLong term assets: Proposed vehicle aims to help DC funds access private asset classes

The UK’s chancellor of the exchequer, Rishi Sunak, has set an ambitious timetable for the launch of a new UK-authorised fund vehicle, the Long-Term Asset Fund (LTAF), by the end of 2021. The LTAF is envisaged to simultaneously help achieve several policy goals by directing pension savings into alternative investments.

-

Asset Class Reports

Asset Class ReportsUS high yield: A changing market

US high yield looks attractive against investment-grade credit although there are important changes for key sectors

-

Country Report

Politics and investment: Germany looks to Sweden

Politicians are looking abroad for ways to boost equity investment in long-term savings

-

Special Report

Special ReportAP3’s partnership approach

Claudia Stanghellini, head of external management at Tredje AP-fonden (AP3), talks about the fund’s strategy when selecting managers

-

Asset Class Reports

Asset Class ReportsTrade Finance: Weathering the storm

Trade and supply-chain finance has faced several threats in recent years but the opportunity for institutional investors is alive and well

-

Country Report

Country ReportAustria: Sustainable growth remains elusive

Austrian providers are calling for solutions to make occupational pensions more appealing in light of demographic pressures and COVID-19 fallout

-

Interviews

InterviewsOn the record: Value makes a comeback

IPE asked two European institutional investors what biases are built in their equity portfolios, as value equities show signs of new-found strength

-

Features

Dual-class share plans fuel concern over stewardship and governance

Introducing dual-class share structures to make London a more competitive financial centre would weaken shareholder rights and make it harder to influence corporate behaviour, institutional investors and trade bodies have warned.

-

Interviews

InterviewsStrategically speaking: Allianz Global Investors

Allianz Global Investors (AGI) has long invested in green infrastructure. The market, and the perception of renewable energy for investors in particular, has changed during this time. Investors are ready to engage with renewable energy or cleantech if the underlying technology has a proven track record.

-

Interviews

InterviewsHow we run our money: Sampension

Henrik Olejasz Larsen, CIO at Denmark’s Sampension, talks to Carlo Svaluto Moreolo about the fund’s bias towards value equities and its diversification strategy

-

Opinion Pieces

Opinion PiecesSustainability: A purpose-driven stock exchange

The UN Sustainable Development Goals (SDGs) have caught the imagination of the investment world. For many in the millennial generation the idea that its investments should fulfil positive social or environmental impacts seems self-evident. Yet many asset managers still struggle to incorporate SDGs into their strategies. Nor do they hesitate to trumpet questionable ESG credentials to investors.

-

Opinion Pieces

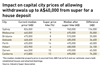

Opinion PiecesLetter from Australia: Should super savings fund homes?

A post-COVID-19 housing boom has made the future of Australia’s A$3trn (€2trn) superannuation savings pool a hot topic.

-

Opinion Pieces

Opinion PiecesLetter from US: Pension bonds raise concerns

The resurgence of interest in pension obligation bonds (POBs) is one of the effects of the pandemic on the US pension funds industry. Indeed in 2020 POB issuance reached its highest level in a decade, exceeding $6bn (€5bn), according to Municipal Market Analytics (MMA), an independent research firm focusing on the US municipal bonds.

-

Features

FeaturesDB accounting: Lump-sum benefits

Service-defined lump-sum payments are causing accounting attribution problems

-

Features

FeaturesPerspective: UK actuaries and COVID-19 – Exceeding expectations

COVID-19 has brought few positive outcomes but the response from UK actuaries could become a template for bringing other strategic challenges to the fore

-

Opinion Pieces

Opinion PiecesGuest viewpoint: Francesco Curto, DWS

The UK’s report into the Economics of Diversity, the Dasgupta review, highlights that our economic model is not sustainable

-

Features

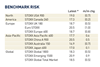

FeaturesFixed Income, Rates, Currencies: Rising yields signal reflation

The Federal Reserve has not hinted at its future plans to unwind quantitative easing (QE). However, markets are looking to 2013’s ‘taper tantrum’ for an explanation of the dramatic US-led bond market sell-offs.

-

Features

FeaturesAhead of the curve: Modelling the unmodellable

In January 2020, the world was on the verge of a pandemic. It would empower the state, increase the might of technology firms, speed up technological adaptation, upend cities and accelerate China’s rise.

-

-