Latest from IPE Magazine – Page 101

-

Country Report

Country ReportCEE – Romania: Funds fight through

Conservative portfolios have served Romanian pension funds well through the crisis

-

Special Report

Special ReportDefined contribution: Australia's super review re-opens old battlegrounds

The Callaghan report on Australia’s universal superannuation system has rekindled a row between the government and the labour movement

-

Opinion Pieces

Opinion PiecesUncertain conditions call for a steady course

The impact of COVID-19 has made long-term strategies that embrace resilience a high priority for pension funds to ensure there is a smoother ride during turbulent times.

-

Country Report

Country ReportCEE – Estonia: Preparing for a liquidity storm

A rule allowing early withdrawals is changing the dynamics of the Estonian pension business

-

Features

FeaturesLong term matters: What kind of decarbonisation matters most?

This article was written on the fifth anniversary of the Paris Agreement. In 2015, the world committed to keep warming below 2°C, meaning decisive annual reductions in greenhouse gas (GHG) emissions. Instead we have had a 7% increase in GHG since 2015 and are on track for about 3°C warming with a high risk of irreversible tipping points.

-

Interviews

InterviewsExit Interview: Peter Borgdorff - “I wasn’t the specialist… and I think that was my advantage”

Polder in the Netherlands is the low-lying land reclaimed from the sea. By extension, it also refers to the highly developed social contract system between politics, business and labour.

-

Interviews

InterviewsExit Interview: Jordi Jofra - Still thinking outside the box

It is well into Spain’s lockdown and Jordi Jofra is ensconced in a village 40km from his former office in Barcelona. One of his lockdown boxes ticked has been to finish reading Men without Women, Haruki Murakami’s best-selling collection of short stories on men and alienation – perhaps appropriate for the times.

-

Interviews

InterviewsOn the record: Search for robust equity portfolios

IPE asked two investors how their equity portfolios are positioned

-

Interviews

InterviewsHow we run our money: BT Pension Scheme

Frank Naylor, CIO of the UK’s BT Pension Scheme, talks to Carlo Svaluto Moreolo about building a resilient portfolio

-

Features

FeaturesESG: Engaging with sovereigns

One of the narratives and unfolding developments in the world of ESG is that of its broadening to asset classes beyond public equity. This generally keeps the focus on corporates, however, while another emerging strand is about sovereign issuers.

-

Opinion Pieces

Opinion PiecesBiodiversity can be measured

Last year was clearly the year of the pandemic. Perhaps the connection between zoonotic disease and biodiversity loss may explain why it has also been the year that biodiversity has become a theme of great interest for investors. Yet current environmental, social and governance (ESG) data and metrics do not cover biodiversity adequately.

-

Opinion Pieces

Opinion PiecesGuest viewpoint: Jesper Kirstein

In recent months, the asset management industry has been dominated by adjustments inspired by the COVID-19 pandemic. This article will try to look beyond this and address the question of where the asset management industry is moving in the medium to long term.

-

Special Report

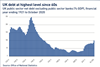

Special ReportAccounting Matters - IAS 19: the negative view

Negative interest rates are probably the most daring policy move most of us will ever see. The idea that a borrower is paid to take out a loan, but a saver is penalised for setting aside money for their retirement turns our understanding of the fundamentals of finance on its head. But Europe has had them for more than a decade. And if the experience of today’s financial crisis is anything to go by, it will do so for a while longer yet. So where does this leave defined benefit (DB) sponsors and their accountants?

-

Opinion Pieces

Opinion PiecesLetter from US: Don’t anticipate radical reform

The new Joe Biden administration is unlikely to revolutionise US pension plans, but it could broaden the base of workers able to join defined contribution plans such as 401(k)s. It may also cancel recent rules and return to the previous regulations set under Barack Obama.

-

Features

FeaturesPerspective: Litigation - state of pay?

Changes in legislation like the UK’s Consumer Rights Act 2015 have led to an increase of class actions led by pension funds as they seek to recover investment losses

-

Features

FeaturesResearch: The shift from virtue to value

In the final article in a series of two, Pascal Blanqué and Amin Rajan argue that the success of ESG investing rests on a just transition to a low carbon future

-

Features

FeaturesStrategically Speaking: Hendrik Bartel, TruValue Labs

What makes ESG data providers stand out? For TruValue Labs, the answer is to apply AI and machine learning to thousands of unstructured data sources to enhance ESG investment processes

-

Features

FeaturesFixed Income, Rates, Currencies: A very different recovery

Amongst the remarkable happenings in 2020, from startling news of a pandemic to viable vaccine and beyond, has been the speed and scale of interventions from central banks and governments.

-

Features

FeaturesAhead of the curve: Options trading as a portfolio diversifier: pilot or passenger?

Options can provide insurance against market volatility, but require detailed knowledge to ensure success

-