Latest from IPE Magazine – Page 98

-

Special Report

Special ReportUK accounting: The Brexit slower ball

Full departure from EU rules means the UK must set up its own accounting standards

-

Interviews

InterviewsOn the Record: Securities lending

We asked two European pension investors how they reconcile their securities lending and short-selling activities with their responsible-investment policies

-

Interviews

InterviewsHow we run our money: Pensionskasse Manor

Martin Roth (pictured), CEO of Pensionskasse Manor, talks to Carlo Svaluto Moreolo about the fund’s diversification strategy and long track record in alternatives

-

Opinion Pieces

Opinion PiecesGuest Viewpoint: Kerrie Waring, International Corporate Governance Network

This year, ICGN’s flagship Global Governance Principles will be revised as part of a three-year review. This year’s revision is set within a world facing systemic challenges: a global pandemic and climate change

-

Opinion Pieces

Opinion PiecesFX Reserves: The ‘rainy day’ has arrived

The world is facing a short-term health and economic crisis with COVID-19. In the longer term it is threatened by an existential crisis with global warming caused by burning fossil fuels.

-

Opinion Pieces

Opinion PiecesLetter from US: COVID and racial justice to the fore

The 2021 proxy season’s hot issues are human capital management related to COVID-19 and social justice. Several large US public pension funds are at the forefront of these campaigns together with non-profit shareholder advocacy organisations like the Interfaith Center on Corporate Responsibility (ICCR) and As You Sow, a non-profit foundation that promotes corporate accountability.

-

Features

FeaturesPerspective: Pooled investors gain a vote

A disruptive new service allows institutional investors in pooled funds to express their stewardship preferences. Will others follow suit?

-

Features

FeaturesChina: Caught in the crossfire

The investment world is at risk of being caught in the midst of a ‘geoeconomic’ conflict between the world’s main economic blocs

-

Features

Rising interest in EM debt

The weak dollar and low US interest rates are pushing governments and companies in emerging markets (EMs) to issue growing volumes of dollar-denominated debt.

-

Features

FeaturesHedge funds: Coping with low interest rates

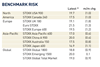

Historical analysis suggests portfolios of certain quant hedge fund strategies may offset some of the risk of rising interest rates

-

Features

FeaturesStrategically Speaking: Capstone Investment Advisors

Last spring’s exceptional market volatility proved the mettle of at least one set of strategies – volatility-focused hedge funds. The CBOE Eurekahedge Tail Risk Hedge Fund index returned a bumper 51.64% in the first three months of 2020 alone against a broad hedge fund market index return of -7.96%, and was up 34.8% for the year.

-

Features

FeaturesFixed Income, Rates, Currencies: Priming the pump

Although COVID-19 infection rates are falling across many regions, the ‘success’ is more a reflection of lockdown restrictions keeping opportunities for virus spread low.

-

Features

FeaturesAhead of the curve: Alternatives investing in a low-yielding world

Investors hoping to replicate bond-like returns (low to mid-single digit, low volatility and drawdown) are facing an unenviable predicament. How can they generate acceptable, positive returns without simultaneously suffering illiquidity, valuation uncertainty, gap risk, and other hard to quantify risks?

-

-

-

Features

FeaturesIPE Quest Expectations Indicator - March 2021

Vaccination figures are rising steadily, but are still at a relatively low level. The US and UK, both important vaccine producers, lead the field with the EU and Japan lagging. As the speed of vaccination has increased, supplies have become a problem, except in the UK. This has caused bad feelings in the EU to the point where a trade war was threatened. New vaccines are in the regulatory pipeline but market shares have largely already been divided in the developed countries. The discovery of new COVID-19 mutations and their resistance to vaccines are an additional risk.

-

Opinion Pieces

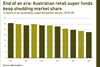

Opinion PiecesLetter from Australia: Retail super funds in distress

Australia’s once-dominant retail super funds are witnessing the end of an era as they wrestle with loss of consumer confidence in their brands. Hastening change has been the rise of industry supers, which benefitted from damaging evidence provided to the Hayne Royal Commission in 2018.

-

Opinion Pieces

Opinion PiecesInfra must adapt to meet pension goals

Looked at collectively, or even individually, the cashflow needs of Europe’s defined benefit (DB) and hybrid pension schemes are huge and potentially challenging given the scale of income generating assets needed to help service them.

-

Asset Class Reports

Asset Class ReportsValue equities: Dead or alive?

Today’s realities and intangibles have changed the face of value

-

Asset Class Reports

Asset Class ReportsHedge fund performance: 2020, year of the human touch

Diversification is back in favour for hedge funds and those with a downside protection mandate delivered during the crisis