Latest from IPE Magazine – Page 106

-

Opinion Pieces

Opinion PiecesLeading viewpoint: Shaping a new landscape

Five key themes within ESG and the case for focusing on them

-

Special Report

Special ReportVersatile and resilient on the path to maturity

The ETF market continues its penetration across asset classes beyond equities, its traditional area of activity: According to data from ETFGI, fixed income ETFs account for the largest proportion of net new assets for the second year running and now represent 20% of the market, while commodities ETFs grew 30% in value in the year to July.

-

Special Report

Special ReportETFs rise to the challenge

Exchange-traded funds and products (ETFs and ETPs) have been one of the biggest investment success stories in recent years. Their stunning popularity meant that, despite the shock of COVID-19, they had taken in US$294bn (€247bn) over the six months to end-June 2020, compared with US$210bn over the same period last year.

-

Special Report

Special ReportBright future for ETFs in pension funds’ portfolios

Despite the phenomenal rise in ETF adoption over the past few years, they still account for a relatively small portion of pension funds’ portfolios. As a recent survey by TrackInsight confirms, ETFs have room to grow with these institutional investors as they fit well with the dual nature of their mandate: meeting short-term liabilities while maximising long-term returns.

-

Special Report

Special ReportAre too many products spoiling the ETF broth?

ETFs have been one of the finance industry’s great successes over the past three decades. With over 8,000 ETFs listed globally, the sector offers highly competitive fees and diversity of product, or so it is assumed.

-

Special Report

Special ReportBond ETFs come of age

In a situation as destructive as a global pandemic is it is difficult to find many winners. Hundreds of thousands of lives have been lost and economies have been brought to the brink – and we may still only be at the start of the saga.

-

Special Report

Special ReportFixed income ETFs: a turning point for European pension funds

Over the past decades, European pension funds have experienced many changes and challenges. Through it all, the European DB market has continued to de-risk, while DC systems have become the new normal.

-

Special Report

Special ReportEmerging market equities – a changing landscape worth revisiting

Emerging market (EM) equities form an important part of many European pension fund growth portfolios today. Investors are keen to capture excess returns on offer thanks to EMs’ risk premium over developed markets, as well as the diversification benefits they can bring to portfolios; these characteristics have been helpful for many of Europe’s DB and DC schemes.

-

Special Report

Special ReportActive ETFs: the transparency conundrum

Since the first exchange-traded funds (ETFs) were launched in the early 1990s, they have had a huge impact on the asset management industry, pushing down costs and challenging the dominance of active managers.

-

Special Report

Special ReportThe case for active ETFs

Each day, more and more institutional investors are discovering how exchange-traded funds (ETFs) can enable them to make trades conveniently, access markets flexibly, diversify portfolios broadly, and manage fees and taxes efficiently.

-

Special Report

Special ReportESG ETFs: northern lights blaze a trail

When the two mainstays of the Finnish earnings-related pension system decided to re-weight their vast passive equity exposure to reflect their environmental, social and governance (ESG) priorities, both found that, despite the plethora of ETFs now available, none met their precise needs.

-

Special Report

Special ReportESG integration demands definitions and data

The first ETF in Europe that focused on environmental, social and governance (ESG) factors was launched by iShares in 2006.

-

Special Report

Special ReportThe heat is on: exploring the role of investors in slowing down climate change

While the Covid-19 crisis this year has had a devastating effect on society and global economies, it has had a positive impact on carbon emissions and has shown us all that it is possible to reduce our carbon emissions drastically. The goal now is to find a happy balance as we reignite global economies. Governments cannot drive progress on their own. So how can the investment industry play its part?

-

Special Report

Special ReportGetting active on stewardship

Providers of passive products like ETFs are no longer passive when it comes to stewardship. In active investment circles, stewardship has always sat naturally beside active stock selection as a way for portfolio managers to add value. That has not been the case on the passive side, where the focus has traditionally been on technical aspects of tracking indices, such as minimising tracking difference, to deliver for investors in terms of relative performance.

-

Special Report

Special ReportLow carbon ETFs: exclusion versus tilting

The rise in investor awareness of climate risks and the increased allocation to passive strategies is set to continue. Tilting is becoming an alternative or complementary approach to traditional exclusion approaches to reducing carbon exposure.

-

Special Report

ESG: remarkable progress, evolving indices and futures growth

The unprecedented economic turmoil caused by the COVID-19 virus has led for calls to reshape the global economy to make it fairer and more environmentally sustainable. Campaigners are challenging governments to direct their record stimulus funds towards projects and investments that benefit broader society.

-

Special Report

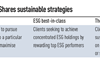

Special ReportFive reasons pension funds are considering indexing for sustainable investing

Sustainable indexing gives pensions the clarity they need to build more sustainable portfolios, for the following reasons:

-

Special Report

Special ReportClassification: not for everyone

In May 2020, BlackRock, State Street Global Advisors, Invesco, Charles Schwab Investment Management and Fidelity Investments set out a new idea that would, they said, re-classify certain types of exchange-traded products and benefit investor transparency.

-

Special Report

Special ReportGetting what you pay for

Price wars are nothing new for passive asset managers, but the contest has been particularly intense in the exchange-traded funds (ETF) space as new and existing players jostle for position. While low cost is always a draw it is clearly not the only factor in the investment decision process.

-

Opinion Pieces

Opinion PiecesNasty problems can be overcome

The Nobel laureate Bill Sharpe once called defined contribution (DC) decumulation the “nastiest, hardest problem in finance”.