Latest on Regulation & Reform – Page 90

-

News

Swiss regulator urges pension funds to check asset manager licenses

Asset managers that received approval by OAK BV until 2019 have to submit a request to FINMA for authorisation to operate by the end of this year

-

News

NewsDutch query EC due diligence proposal pension fund scope, fit

Pensioenfederatie calls for clarification and amendment of Commission’s proposed corporate sustainability due diligence directive proposal

-

News

French groups agree sponsored research charter in post-MIFID II move

Move follows recommendation of financial regulator and drop in number of companies covered by independent research

-

News

Social partners plan to expand DC model for chemical industry to further sectors

BAVC and trade union IGBCE expect to start the new pension model from 1 October 2022

-

News

Hybrid pension funds want clarity on pension transition

Dutch multi-sector schemes including PGB, PNO Media and SBZ Pensioen fear they may not be able to make the switch to DC under the proposed legal framework

-

News

KLP says rising rates will lead to higher revenues after 0.75% Q1 loss

Introduction of a common buffer fund helped to strengthen KLP’s capital adequacy, says CEO of Norwegian municipal pensions giant

-

News

UK court blesses charity trustees’ Paris-aligned strategies

Judge decides trustees ‘adequately balanced’ envrionmental goal with financial detriment

-

News

UK roundup: Queen’s Speech fails to mention new Pensions Bill, autoenrolment plans

Plus: DB schemes see improved health; Buck launches DB governance tool

-

News

NewsDutch parliament calls for pension indexation

A majority of the Dutch Second Chamber wants pensions minister Carola Schouten to press pension funds to index pensions wherever possible

-

News

Velliv warns about official proposal to curb rises in pension age

Chief economist of Danish pension provider says commission’s idea removes 80,000 from already stretched workforce

-

News

NewsDanish Pension Commission advises slowing the increase in pension age

Official panel produces long-awaited report, proposing changes ‘to equip the system for the future’

-

News

Regs on trustee oversight of consultants, fiduciary managers in ‘late 2022’

CMA ’annual concurrency report’ reveals updated timings

-

News

France’s UMR to incorporate as new pension fund vehicle

A dedicated pensions mutual, UMR considers the FRPS regime to be better suited to it as a long-term actor

-

News

NewsEFRAG flags SFDR PAI links in draft corporate reporting standards

Draft EU corporate sustainability reporting standards out for consultation

-

Country Report

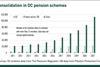

Country ReportUK: The long and winding road to consolidation

Brexit, COVID and other factors delay regulation that would enable commercial DB scheme consolidators to operate

-

Features

FeaturesInvestors sceptical on Tokyo equity market reforms

In April, the Tokyo Stock Exchange (TSE) implemented its biggest overhaul in over 60 years in an attempt to attract foreign investors. However, many industry experts see the move as largely symbolic and believe more needs to be done to create a roster of high-quality companies with strong corporate governance practices.

-

Features

FeaturesDerivatives: countdown to mandatory margin

From 1 September, a large number of pension funds and clients of asset managers will be required to start posting initial margin on their non-cleared derivatives exposures, a change that will have a big impact on how they conduct business. The problem is that many institutions may not be fully aware of the implications or what they need to do to prepare – and time is running out.

-

News

NewsISSB unveils new advisory body, EFRAG names TEG members

New ISSB body to focus on enhancing compatibility between global baseline and jurisdictional initatives

-

News

NewsSwiss parliamentary committee amends second pillar reform

Both the SGK-S and the National Council agree on the reduction of the conversion rate from the current 6.8% to 6%

-

News

NewsEIOPA proposes new pensions info-gathering to close ‘important’ data gaps

Regulator says its capacity to analyse emerging risks is currently limited