All IPE articles in May 2017 (Magazine) – Page 3

-

Special Report

Global Defined Contribution: Targeting the right glidepath

Christopher O’Dea finds defined contribution pension sponsors are increasingly looking for more flexibility in target-date funds to cope with changing worker demographics

-

Special Report

Gaining currency as a risk control

Lynn Strongin Dodds finds that worries about currency risk are leading investors to consider factor-based approach when investing in foreign exchange markets

-

Features

Creative destruction is needed

The current vogue for optimism about the prospects for the developed economies is overdone. There may be a slight cyclical upturn but its significance is limited

-

Special Report

The great factor debate

Daniel Ben-Ami examines a key question that is too often neglected: why does factor investing work?

-

Features

Diary of an Investor: Looking the part

We at Wasserdicht Pension Funds have been using BIG Asset Management for what seems like an eternity. I have learned two things about BIG over the years

-

Features

Discount Rates: An exercise of judgement

A pension fund sponsor in Ecuador has raised an important point about IAS 19 discount rates, reports Stephen Bouvier

-

Features

Global Economy: Is growth optimism justified?

Daniel Ben-Ami finds that while there are signs that the global economy might be bouncing back, doubts are being raised by the weakness of the recovery

-

Special Report

Full of EM promise

David Turner finds elements of factor investing that could make the strategy ideal for emerging markets

-

Special Report

Listed Equity: The five tests of impact

Andrew Parry argues that five key tests should be applied to public market investments before they can be termed impact investments

-

Special Report

Listed Equity: A public role

New indices and ETFs apply impact investment to liquid equities. But corporate reporting and investor focus are central, according to Liam Kennedy

-

Special Report

Special ReportSpecial Report Factor Investing: Meeting expectations

It is important to have realistic expectations about what factor investment can deliver

-

Special Report

A risk-reducing factor

Many factor investors use timing as a way to reduce risks, writes David Turner

-

Interviews

Focus Group: Risk-factor strategies in favour

Over three-quarters of the respondents to this month’s Focus Group are allocated to strategies that employ risk-factor investing concepts, with four of these considering further allocations

-

Special Report

McKnight Foundation: Sticking to impact

Christopher O’Dea speaks to the McKnight Foundation of Minnesota about its $200m commitment to impact investment strategies

-

Country Report

Country ReportPensions In France: Why make it simple?

French pension schemes are up in arms over plans for a decree they say imposes harmful constraints on how they manage their assets. Susanna Rust reports

-

Special Report

A new frontier?

Everyone seems to want to talk about investing for impact these days. But a lack of a common understanding can make this difficult, according to Susanna Rust

-

Special Report

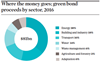

Special ReportGreen growth

High levels of green bond issuance have sparked investor interest and spawned funds and strategies, writes Rachel Fixsen

-

Opinion Pieces

Opinion PiecesLetter from the US: Risk transfer hots up

With interest rates rising, the US pension risk transfer market is expected to grow substantially

-

Interviews

InterviewsHow we run our money: Varma

Reima Rytsölä, CIO of Finnish pension fund Varma, tells Carlo Svaluto Moreolo why it makes sense to keep an allocation to hedge funds

-

Special Report

Special ReportSpecial Report: Investing for Impact

Although relatively new, impact investing is still the term that has been around the longest to describe investing with the explicit purpose of achieving positive non-financial impacts in addition to financial gain

- Previous Page

- Page1

- Page2

- Page3

- Page4

- Next Page