All IPE articles in May 2022 (Magazine)

View all stories from this issue.

-

Country Report

Country ReportCountry Report – Pensions in the UK (May 2022)

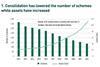

The 80-plus local government pension funds in England and Wales have been on course to consolidate into eight asset pools for the last six years, with a target of €1-2bn in cost savings by 2033.

-

Features

FeaturesQontigo Riskwatch - May 2022

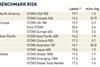

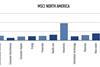

* Data as of 31 March 2022. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

Features

FeaturesIPE Quest Expectations Indicator commentary May 2022

Ukraine is slowly gaining the upper hand, while Russia is still unwilling to make concessions. Putin is trying to play his nuclear card, a dangerous move, making himself the major obstacle to stopping the appalling Russian losses in people and equipment. Meanwhile, Zelensky lost points by creating an issue with Germany when he can’t afford to lose points.

-

Features

FeaturesAccounting: IASB shortlist of projects hits a snag

The best laid plans of mice and men often go awry. Or so they say. March was supposed to be the month when the International Accounting Standards Board (IASB) whittled down its shortlist of potential standard-setting projects for a final vote in April. But nothing ever goes to plan.

-

Opinion Pieces

Opinion PiecesShareholder action to curb corporate lobbying is urgent

Corporate lobbying has always existed, but only in recent times have investors concerned with sustainability started to monitor the impact of the lobbying activities of their investee companies.

-

Country Report

Country ReportUK: Auto-enrolment after a decade: broadening the scope

The UK is exploring how to bring younger, part-time, and lower paid workers into the scope of its successful auto-enrolment regime

-

Features

FeaturesAhead of the curve: China treads a careful path

Since the Tiananmen Square protests in 1989 the Chinese Communist Party has not put a foot wrong domestically. It has pursued economic growth alongside social cohesion, entrenching its prime objective of staying in power.

-

Analysis

AnalysisPortfolio analysis: to net or not to net?

Portfolio alignment tools can help build a clearer picture of overall portfolio impact but accounting for negative externalities is problematic

-

Interviews

InterviewsStrategically speaking interview: Sandro Pierri, BNP Paribas Asset Management

Like many of his counterparts at large asset management firms, Sandro Pierri is mindful of how global trends are influencing his clients and the best ways for his firm to address them.

-

Opinion Pieces

Opinion PiecesAustralia: A new sense of unity over superannuation funds

Australia’s leading political parties appear to have called a truce over often-politicised issues in the superannuation sector in the lead-up to this May’s Federal election.

-

Country Report

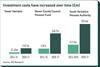

Country ReportUK: Behind the pooling figures for local government pensions

Comparing the cost savings of the eight local government pension scheme pools is a complex exercise

-

Country Report

Country ReportUK: Interview with Sally Bridgeland

Sally Bridgeland, chair of Local Pensions Partnership Investments, discusses the institution’s net-zero carbon emission and cost-reduction strategies

-

Opinion Pieces

Opinion PiecesGuest viewpoint: How can DC schemes build a more sustainable future?

The UK government’s Build Back Better growth plan paves the way for significant investment in infrastructure, which could be attractive for defined contribution schemes. How might they take advantage of opportunities to improve outcomes for savers?

-

Opinion Pieces

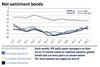

Opinion PiecesRobust central clearing is critical for millions of Europeans

Derivatives like interest rate swaps are now a central component of risk management best practice. According to a 2018 paper by ISDA and PensionsEurope, the percentage of hedged pension liabilities in Denmark, the Netherlands and the UK ranges from 40-60% of total liabilities.

-

Special Report

Special ReportDriving change as the debate on impact evolves

It’s hard to believe, but this is IPE’s fifth annual special report dedicated to investing for impact: our first impact investing report was in 2018. What has changed since then? In some ways not much. We still have a debate about the credibility of claiming impact in public markets, where the narrative is all about stewardship in the form of engagement and voting, and we discuss the effectiveness of engagement versus divestment.

-

Asset Class Reports

Asset Class ReportsEmerging markets: Investors stay positive on Chinese investments

Many Western investors are staying put in China. But Russia’s invasion of Ukraine has given them pause over what might change their stance

-

Opinion Pieces

Opinion PiecesUS: The SEC’s new climate disclosure rule is a watershed

Most investors, asset managers and consultants look like they are in favour.

-

Special Report

UK Stewardship Code: a platform for impact

Investors and specialist managers could use the UK’s revised Stewardship Code to showcase intentionality and impact

-

Country Report

Country ReportUK: Collective defined contribution pensions move up a gear

The first collective defined contribution pension scheme is set to launch after years of stop-start progress. But obstacles remain