All IPE articles in May 2022 (Magazine) – Page 2

-

Special Report

Special ReportCorporate lobbying comes under the spotlight

Companies are starting to respond to investors’ demands for transparent and consistent lobbying.

-

Special Report

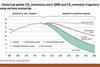

Special ReportConsigning fossil fuels to the past

How are asset managers supporting the shift away from fossil fuels in energy intensive sectors?

-

Country Report

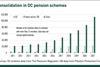

Country ReportUK: The long and winding road to consolidation

Brexit, COVID and other factors delay regulation that would enable commercial DB scheme consolidators to operate

-

Interviews

InterviewsOn the record: Impact through corporate engagement

Investors are aiming to maximise the impact of their investment strategies by engaging with investee companies

-

Features

FeaturesDerivatives: countdown to mandatory margin

From 1 September, a large number of pension funds and clients of asset managers will be required to start posting initial margin on their non-cleared derivatives exposures, a change that will have a big impact on how they conduct business. The problem is that many institutions may not be fully aware of the implications or what they need to do to prepare – and time is running out.

-

Features

FeaturesFixed income, rates & currency: Markets grapple with inflation and slowdown

The global outlook for economic growth is deteriorating, with repeatedly revised economic forecasts pointing to ever-higher inflation and lower GDP growth. The far-reaching impacts of the Russia-Ukraine war, moving principally through energy and commodity channels, have exacerbated so many of the world’s existing pandemic-related supply-side bottlenecks, which had been gradually easing in the weeks and months before Russia invaded.

-

Country Report

Country ReportUK: Pension dashboards make slow progress

DWP timeline is met with optimism but complex UK system throws up problems

-

Special Report

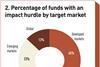

Special ReportData: focus on impact hurdles

An increasing number of impact funds link carried interest to impact goals. Asset owners can help by encouraging this trend

-

Special Report

Special ReportStrategy: The search for integrity and effectiveness

Investors are increasingly seeking real-world impact, but understanding of what that means and how it can best be achieved is still evolving.

-

Asset Class Reports

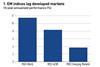

Asset Class ReportsEmerging markets: Global or local?

For emerging market strategies, it is difficult to establish a clear link between performance and local presence

-

Asset Class Reports

Asset Class ReportsPortfolio strategy – Emerging markets

It is no secret that while investments in emerging markets promise to deliver superior returns, thanks to their exposure to faster-growing economies, actual performance has been volatile and, at times, disappointing. Over the past decade, emerging market indices have outperformed, as have fund strategies.

-

Features

FeaturesInvestors sceptical on Tokyo equity market reforms

In April, the Tokyo Stock Exchange (TSE) implemented its biggest overhaul in over 60 years in an attempt to attract foreign investors. However, many industry experts see the move as largely symbolic and believe more needs to be done to create a roster of high-quality companies with strong corporate governance practices.

-

Features

FeaturesMeasuring health impacts could expand ESG metrics

All companies have an impact on the world beyond just the profits for shareholders. Acknowledging and measuring these impacts in a quantitative manner enables them to be managed for the benefit of all and contributes to the creation of a fairer and more just society. The environment, social and governance (ESG) movement has raised the importance of such sentiments.

-

Opinion Pieces

Seesawing rates pivot European pension funding ratios

Many pension funds throughout Europe have had insufficient funding ratios for many years in part due to falling interest rates, even though pension funds’ investment choices and contribution levels also play a role.

-

Opinion Pieces

Opinion PiecesNotes from the Nordics: Finland on the frontier

Fear and uncertainty are rattling markets, but financial concerns are dwarfed by the human suffering caused by the war in Ukraine. In Finland, people have particular reason to worry due to the country’s long land border with Russia.

-

Interviews

InterviewsIlmarinen: The making of a Finnish pensions legend

Mikko Mursula (pictured), CIO of Finland’s Ilmarinen, talks to Carlo Svaluto Moreolo about equities and the organisation’s 2035 net-zero commitment

-

Features

FeaturesInvestors grapple with sustainability in short selling strategies

The recent move by the EU to exclude derivatives from sustainable strategies has focused attention on the role of short selling in promoting lower carbon emissions

-

Special Report

Special ReportTowards a sustainable portfolio theory

Applying monetary values to impacts would allow investors to direct capital better and assess opportunities for improved long-term returns

- Previous Page

- Page1

- Page2

- Next Page