More comment – Page 26

-

Opinion Pieces

Opinion PiecesStrategy reset during a pandemic

Just over six months into the job, Nicolai Tangen, who took over as CEO of Norges Bank Investment Management (NBIM) last September from Yngve Slyngstad, has already revised the asset manager’s strategy plan for this year and next.

-

Opinion Pieces

Opinion PiecesOECD: plans to mobilise institutional capital

The OECD is committed to facilitating development finance through structures that provide a commercial return

-

Opinion Pieces

Opinion PiecesAfrica offers Europe opportunities

In 2015, Europe faced the prospect of a million Syrian refugees fleeing from civil war, attempting to cross into its borders. The sudden influx created a political as well as a humanitarian crisis with Hungary building a 175km-long fence to prevent crossings from the Balkans.

-

Opinion Pieces

Opinion PiecesLetter from Australia: A question of gender imbalance

Statistics offer a snapshot into the real world and they reveal a depressing picture of gender inequality in Australia’s superannuation system.

-

Opinion Pieces

Opinion PiecesLetter from US: Aid without reform set to resolve the multi-employer pension plan crisis

Until March, The prospective collapse of multi-employer pension plans meant that over one million retired truck drivers, shop assistants, builders and other members of 186 schemes were at risk of losing their retirement benefits.

-

Opinion Pieces

Opinion PiecesGuest Viewpoint: Pension funds are key to the recovery from COVID-19

The unprecedented situation resulting from the COVID-19 pandemic has shown that pension funds serve a key social function in supporting economies and citizens, ensuring benefits for old age income.

-

Book Review

Book ReviewBook review: Shooting for the moon

Mariana Mazzucato calls on us to reformulate capitalism itself, and to return to the ‘Big Government’ rejected by the baby-boomer generation

-

Opinion Pieces

Opinion PiecesEquities to the fore as an inflation hedge

At a time when institutions can deploy billions swiftly at the touch of a few buttons, there is increasing focus on deploying capital well. A notable buzzword of late has been ‘resilience’ as pension funds look to downside risks.

-

Opinion Pieces

Opinion PiecesHopes for coherence in sustainability disclosures regulations

It could have been done differently, but, nonetheless, a clear path is emerging as to how EU sustainable finance regulations will become more of a coherent whole. The problem that has been perceived and outlined time and time again by investor groups is that disclosures are being asked of their constituencies – asset managers, pension funds – for which the data is not really available, or only at a significant cost. Tough, some may say, get on with it.

-

Opinion Pieces

Opinion PiecesGreen ambitions to drive recovery

Last month, Italy announced its first foray into the hot market of green bonds by raising a record €8.5bn (see page 9).

-

Opinion Pieces

Opinion PiecesSustainability: A purpose-driven stock exchange

The UN Sustainable Development Goals (SDGs) have caught the imagination of the investment world. For many in the millennial generation the idea that its investments should fulfil positive social or environmental impacts seems self-evident. Yet many asset managers still struggle to incorporate SDGs into their strategies. Nor do they hesitate to trumpet questionable ESG credentials to investors.

-

Opinion Pieces

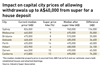

Opinion PiecesLetter from Australia: Should super savings fund homes?

A post-COVID-19 housing boom has made the future of Australia’s A$3trn (€2trn) superannuation savings pool a hot topic.

-

Opinion Pieces

Opinion PiecesLetter from US: Pension bonds raise concerns

The resurgence of interest in pension obligation bonds (POBs) is one of the effects of the pandemic on the US pension funds industry. Indeed in 2020 POB issuance reached its highest level in a decade, exceeding $6bn (€5bn), according to Municipal Market Analytics (MMA), an independent research firm focusing on the US municipal bonds.

-

Opinion Pieces

Opinion PiecesGuest viewpoint: Francesco Curto, DWS

The UK’s report into the Economics of Diversity, the Dasgupta review, highlights that our economic model is not sustainable

-

Opinion Pieces

Opinion PiecesViewpoint: Schemes must align climate goals with overall endgame objectives

Over the next 10 to 30 years, pension schemes face two major challenges: ensuring that member promises can be paid in full and on time and climate change

-

Opinion Pieces

Opinion PiecesCapital will drive best practice in reporting

The European Commission’s review of the Non-Financial Reporting Directive (NFRD), scheduled for publication shortly, comes at a time of increased scrutiny of both corporates and those who supply them with debt and equity.

-

Opinion Pieces

Opinion PiecesCulture wars pose the greatest dangers

What areas within the increasingly bitter conflict between China and the West are most likely to hit asset owners?

-

Opinion Pieces

Opinion Pieces‘Whatever it takes’ may not be enough

Italy has another new government; the 67th since 1946. An argument over the management of EU COVID-19 recovery funds led to the appointment of Mario Draghi, the former president of the European Central Bank (ECB), as prime minister. He is after all credited with saving the euro-zone by pledging to do “whatever it takes” during the 2012 debt crisis.

-

Opinion Pieces

Opinion Pieces‘Urgency’ necessary for adequate provision

The IORP II Directive seeks to “improve the way occupational pension funds are governed”, to “enhance information transparency” to pension savers and to “clarify the procedures for carrying out cross-border transfers and activities”, according to EIOPA.

-

Opinion Pieces

Opinion PiecesGuest Viewpoint: Kerrie Waring, International Corporate Governance Network

This year, ICGN’s flagship Global Governance Principles will be revised as part of a three-year review. This year’s revision is set within a world facing systemic challenges: a global pandemic and climate change