More comment – Page 30

-

Opinion Pieces

Opinion PiecesLetter from Australia: ESG stirs some ancient ghosts

In May this year, Rio Tinto blew up one of Western Australia’s most significant Aboriginal heritage sites.

-

Opinion Pieces

Opinion PiecesLetter from US: All eyes on CalPERS as CIO quits

The $405bn (€342bn) California Public Employee’ Retirement System (CalPERS) is the bellwether of US public pension funds.

-

Opinion Pieces

Opinion PiecesGuest ViewPoint: Peter Laurelli, eVestment

Comparing asset management fees across firms, strategies and regions is not a simple task. There are frequently differences, sometimes large, in what asset managers state they charge in their marketing materials, and the fees they actually negotiate during due diligence and selection processes.

-

Opinion Pieces

Opinion PiecesViewpoint: Adding to financial thinking

Peter Kraneveld applies statistical theory to COVID-19 and concludes that investors should start thinking about events that have no mean regression

-

Opinion Pieces

Opinion PiecesA long sunset on a fragile model

The ECB’s move in September 2019 to lower rates and restart corporate bond purchases was a clear red warning signal to defined benefit pension funds and other liability-driven investors.

-

Opinion Pieces

Opinion PiecesMaking a difference

“This time is different”. Such claims were rightly skewered in a well-known book by Carmen Reinhart and Kenneth Rogoff. But with the benefit of recent experience it should be clear that their argument did not go far enough.

-

Opinion Pieces

Opinion PiecesThe post-pandemic economy could be more of the same

There seems to be a consensus that COVID-19 will bring momentous change to the global economic order. Commentators point to several developments to support this idea.

-

Opinion Pieces

Opinion PiecesTake from the young to give to the old

For many years, the Dutch pension system was considered one of the world’s best – it was top in class with Denmark in the Melbourne Mercer Global Pension Index annual study last year.

-

Analysis

AnalysisEcology: A car crash in nature

Vian Sharif, head of sustainability at FNZ Group, never imagined her recently completed PhD thesis would have implications for global health. The subject was the trade in endangered animal products such as the scales of pangolins.

-

Opinion Pieces

Opinion PiecesLetter from US: Diversity in asset management rises

“It is a part of your fiduciary duty to invest the fund’s assets in a prudent manner. Investing with diverse asset managers that demonstrate outperformance and deliver strong returns is more than prudent, it is wise.”

-

Opinion Pieces

Opinion PiecesGuest Viewpoint: The growing influence of index providers

Pension funds have shifted assets worth hundreds of billions from actively managed funds to passive funds in recent years. In doing so, they are part of an ongoing money mass-migration from high-fee active funds to low-fee index funds.

-

Opinion Pieces

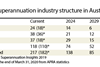

Opinion PiecesLetter from Australia: Pooling for savings and strength

The government, the regulator and economic fallout from COVID-19 have combined to pressure Australia’s large and unwieldy pool of super funds towards consolidation.

-

Opinion Pieces

Opinion PiecesViewpoint: COVID-19 and fund secondaries – how should pension schemes position themselves?

How should pension schemes best position themselves to take advantage of portfolio secondary sales opportunities? Are there lessons to be learnt from the GFC for pension schemes selling portfolio positions during COVID-19?

-

Opinion Pieces

Opinion PiecesViewpoint: Managing euro zone sovereign risk in the face of the pandemic

Considerations for pension plans and other institutional investors

-

Opinion Pieces

Opinion PiecesViewpoint: Post-COVID-19 predictions

Left and right, predictions on the post COVID-19 era are shooting by

-

Opinion Pieces

Opinion PiecesViewpoint: UK superfunds – Super fast, or dead in the water?

Will the superfund ship lawfully leave port any time soon? Following the UK pension regulator’s publication of its interim regime for superfunds in June 2020, there is much talk about scheme transfers to superfund being imminent. Clive Weber, pensions partner, and Paul Ashcroft, solicitor, Wedlake Bell LLP, explain why the ...

-

Opinion Pieces

Opinion PiecesViewpoint: Majority of DC schemes not ready for illiquid assets

But the outlook for change may be positive

-

Opinion Pieces

Opinion PiecesViewpoint: Returns to ESG investing - looking for the light

A fundamental question for investors is whether ESG investment involves a tradeoff, a combination of environmental philanthropy and reduced financial returns, or whether ESG investment will simply deliver the best returns to investors.

-

Opinion Pieces

Opinion PiecesViewpoint: The best things in life aren’t things

Peter Kraneveld argues that ESG and SDG investments are held up to a false standard, underestimating their real revenue and hindering solutions.

-

Opinion Pieces

Opinion PiecesViewpoint: Investing after the Corona Slump

What are the facts that we know and that we can rely on when thinking about portfolio construction?