Recent tariff-driven market volatility has prompted a growing number of defined contribution (DC) providers to reassess US equity allocation, according to Isio’s quarterly report analysing investment performance and asset allocation of 12 major UK DC master trust providers.

The “Liberation Day” tariff announcement at the start of Q2 sparked a sharp equity sell-off as investors moved into safe-haven assets, Isio said.

It added that markets rebounded quickly when most tariffs were suspended, but volatility highlighted ongoing risks for DC schemes heavily weighted to the US market.

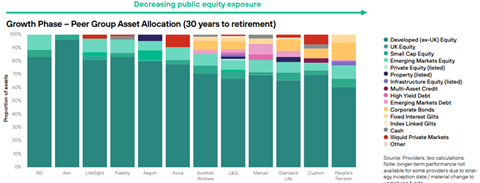

According to Isio’s report, in Q2 more providers reduced their US allocations, reflecting concerns over tariff uncertainty, potential dollar weakness, and concentration in a small number of richly valued mega-cap growth stocks.

While the US continues to dominate global indices, Isio pointed out that its weighting is significantly higher than its share of world GDP, prompting a broader reassessment of strategic equity exposures.

Isio pointed out that despite the initial turbulence, growth phase portfolios recovered strongly as equities bounced back and said there is value in the discussions emerging this year around growing scrutiny of US exceptionalism and its implications for strategic equity allocations over longer timeframes.

However, it stressed that members who are decades from retirement benefit most from long-term investment discipline and reacting impulsively to short-term shocks risks undermining compounding returns.

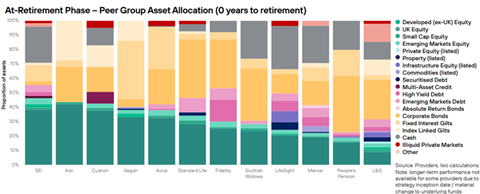

Isio’s report showed that all the retirement-phase strategies assessed by the consultancy delivered positive returns in Q2. Despite material differences in asset allocation, performance was clustered within a narrow range, underlining the resilience of diversified portfolios in volatile conditions, it said.

It added that the most diversified at-retirement strategy recorded the strongest performance, demonstrating the value of spreading risk appropriately to protect members’ outcomes.

Sukhdeep Randhawa, director at Isio, said: “This quarter has been a reminder of two key principles for DC investing: don’t panic in the growth phase and diversify appropriately in retirement. While tariff turmoil sparked short-term market shocks, the bigger picture is that providers are now reconsidering how much reliance they place on US equities over the long term. For members, it is clear that strategies built for discipline and diversification remain best placed to deliver resilience and long-term value.”

People’s Partnership chief investment officer Dan Mikulskis has also previously urged pension schemes not to get distracted by elections and geopolitics when making investment decisions and instead focus on the long term.

Speaking at the Pensions UK conference in Edinburgh in February, Mikulskis said that elections and geopolitics are “really just distractions” and while they “deeply matter” for people’s lives, the biggest risk to investors is “getting too distracted” by these events, and making investment decisions off the back of them.

Read the digital edition of IPE’s latest magazine