The UK government and trust-based pensions regulator have backed new value for money proposals for the defined contribution market that include the addition of forward-looking metrics and a more granular rating system.

Published yesterday, the proposals are a response to industry feedback to a value for money assessment framework put forward by the Financial Conduct Authority (FCA), which regulates contract-based pensions, in August 2024.

The Department of Work and Pensions (DWP) and The Pensions Regulator (TPR) have been working with the FCA on a value for money framework, and this time round, the proposals also represent a formal discussion paper for trust-based pension arrangements, inviting input that can be used in developing the regulations enabled by the Pension Schemes Bill currently progressing through Parliament.

“This framework will empower decision-makers to either improve their scheme or consolidate out of the market,” said Nausicaa Delfas, chief executive of TPR, which regulates trust-based pension plans in the UK.

“We want to hear the views of trustees to make sure we get this right and help transform pension saving for millions.”

Gail Izat, workplace managing director at Standard Life, part of Phoenix Group, said there had “clearly been a lot of interaction between FCA, TPR and DWP in developing the system and we’d like to see this continue as the framework is implemented to ensure consistency between the contract and trust-based worlds”.

Revisions

Building on feedback to last year’s consultation, the new proposals include measures showing what returns and risks savers can expect over the next 10 years, to be considered alongside an updated set of backward-looking metrics.

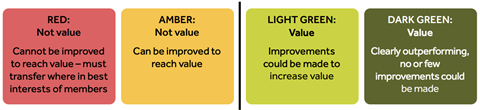

In addition, value for money assessment outcomes would be shown in one of four colour ratings rather than three. Under the previous proposals, an arrangement could be either red, amber or green, but now the green category been split into light green and dark green.

Pensions minister Torsten Bell said the proposed framework was “about being straight with people and making sure people’s savings work as hard as they did to earn them”.

Other changes include a reduced set of data to assess costs and backward-looking investment performance metrics, and proposals that pension scheme plans be compared against a much wider commercial comparator group.

There were also changes to proposals for quality of service metrics, although the regulators said further exchanges with industry were required to ensure member engagement indicators are meaningful, so they have not been included in the discussion paper.

As currently envisaged, service measures can maintain or downgrade but not improve a provider’s rating.

TPR noted that the framework also sets out “stronger governance with clear expectations for trustees and providers” and “fixing poor-value pension arrangements, including telling the regulators and limiting new members joining”.

Helen Forrest Hall, chief strategy officer at the Pensions Management Institute, said the new framework was a positive step towards better saver outcomes but that “ambition must match reality”.

“Schemes face heavy pressures, and added burdens must stay proportionate,” she added. “Clear communication will be critical to avoid confusing members. We will work with government and regulators to ensure the rules are practical, consistent across schemes, and deliver long-term value for savers.”

The joint proposals are open for comment until 8 March. A group of DC master trust providers have already engaged in a pilot exercise to test value-based metrics.