Fonds de réserve pour les retraites (FRR), the €21bn French public sector fund, is looking to appoint managers to run some €1.75bn of equity index mandates, with new, tighter responsible investment criteria.

“Building on the previous 2021 tender, FRR now requires clear, continuous, and measurable improvements in ESG characteristics, such as reducing greenhouse gas emissions compared to the index and throughout the mandate’s life, or protecting biodiversity,” the asset owner said in a statement this week.

The pension reserve fund also said it wanted asset managers to emphasise forward-looking metrics like green capital expenditure, “to anticipate structural changes in the economy”.

Strong shareholder engagement would also be expected, it said.

A member of the UN Net-Zero Asset Owner Alliance, FRR has pledged to achieve carbon neutrality in its investment portfolios by 2050. It is also a member of Climate Action 100+ and Nature Action 100, a relatively new network that convenes shareholders to engage with key companies on nature-related risks.

FRR said the list of eligible benchmarks would be provided in the second phase of the request for proposal (RFP), and that the fund would decide the allocation of the indices among the selected managers after the tender process.

The indices will be customised in advance by FRR’s providers, with whom the reserve fund works directly, it said.

The goal is to select asset managers who can replicate equity benchmark indices with sector neutrality, while staying within a defined tracking error.

In supporting tender documents, FRR said the tracking error budget would depend on the specific index being replicated. It said about 80% of the index panel consists of optimised strategies with few or no ESG constraints and that asset managers would therefore need to make significant adjustments.

It said this typically resulted in a tracking error in the 2–3% range.

“This is largely due to the fact that the underlying indices tend to be quite concentrated, averaging around 80 constituents,” it said.

The remaining 20% of the index panel are climate indices that already incorporate FRR’s sustainability requirements, so adjustments would be smaller and the tracking error lower.

‘Advancing market practice’

For FRR, the RFP “reinforces the growing importance of ESG criteria in its portfolio and shows its commitment to driving market practices toward more responsible, transparent, and resilient finance”.

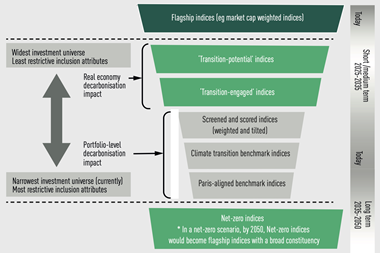

Adrien Perret, executive director at FRR, previously told IPE that “there’s a growing need to broaden the work on index investing and climate change”.

The target amount for the tender is around €1.75bn, with the mandates to run for five years with a possible one-year extension. Geographically, the focus is on the euro zone.