The United Nations-convened Net-Zero Asset Owner Alliance has finalised the framework according to which individual members will be publishing their 2025 portfolio decarbonisation targets to support the goal of net-zero emissions by 2050.

According to the group, the 2025 target-setting protocol and the subsequent issuing of individual targets represents the first time major investors set and commit to report on interim targets on the way to the 2050 objective.

Writing in the foreword of the protocol, former UN climate change chief and founding partner of a strategic and scientific partner of the Alliance, Christiana Figueres said: “Issuing transparent, rigorous and realistic targets, and then committing to report against them in the next four years, is at once an extraordinary – and also essential – demonstration of ambition by private sector leaders who exist at the pinnacle of our financial systems.”

As already declared upon the release of the draft protocol, the 33 Alliance members will be setting 2025 emission reduction targets within a 16-29 percent range.

A consultation on the draft protocol drew 37 submissions from individuals plus a range of organisations, such as NGOs, climate data or analytics providers, and corporates, according to Udo Riese, ESG integration lead at Allianz Investment Management SE and co-chair of the Alliance’s working group on methods, reporting and verification.

He told IPE the amount of feedback was quite positive, but that it was “a little bit disappointing” there was almost none from financial institutions other than the members of the Alliance.

The feedback that was received was overall supportive, and in some areas very “diverse”, according to Riese. The latter point was behind one of the main changes the Alliance made to the draft protocol, concerning the measurement of emission targets.

In the draft protocol there was a slight recommendation for absolute emission targets over intensity-based ones, but following feedback arguing “in both directions” the final protocol is neutral on this point, Riese explained.

The other main changes were to include more explicit wording about how activity based on the protocol is aligned with fiduciary duty – following feedback from the US – and to strengthen the importance assigned to policy advocacy.

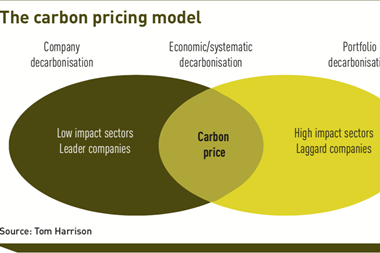

Under the “engagement targets” part of the protocol, the final version states that asset owners should “set action targets on policy advocacy”. There was consensus about the importance of carbon pricing, said Riese.

“The founding of the Alliance and the publication of the protocol has set the net-zero implementation ball rolling”

Günther Thallinger, chair of the Net-Zero Asset Owners Alliance and member of the board of management at Allianz SE

According to the protocol, members of the alliance should also set sub-portfolio and later portfolio emission targets, sector targets, and “financing transition” targets. They are recommended to set targets on all four parts, and must do so for engagement.

Members of the alliance should start to publish their 2025 decarbonisation targets over the coming months, if not sooner.

“The founding of the Alliance and the publication of the protocol has set the net-zero implementation ball rolling,” said Günther Thallinger, chair of the Alliance and member of the board of management at Allianz SE.

“Investors and companies across the globe must follow by publishing their own rigorous, science-based and accountable targets.”

In the latest sign of the momentum behind net-zero emission declarations by asset owners, albeit not always within the framework of the Net-Zero Asset Owners Alliance, Aegon UK today announced a 2050 net-zero target for its auto-enrolment default pension funds, plus the ambition to halve the emissions associated with the funds by 2030.