The UK’s defined benefit (DB) pension market is undergoing a transformation, with professional trustees playing an increasingly pivotal role in its governance and strategy. Recent reports from consultancies LCP and Isio shed light on the growing influence of this type of industry stakeholders, and highlight the challenges they face in shaping the future of pension schemes.

LCP’s report – The Pensions Powerbrokers – shows that fewer than 500 trustees oversee more than half a trillion pounds of DB pension assets in the UK. This small group wields significant influence over investment decisions and scheme endgames, yet their voices are often absent from policymaking discussions.

Nathalie Sims, partner at LCP, said: “It is worrying that many feel that their voice is not being heard in the corridors of power, and this omission must be addressed as a matter of urgency if we are to get the best out of the money invested in the UK pension system.”

LCP’s research also underscores the value of member-nominated trustees, who bring diverse perspectives and practical insights to trustee boards.

“Member trustees can ask commonsense questions about technical material and often bring a deep understanding of the company and the needs of the scheme membership,” LCP stated.

The rise of professional trustee firms

Isio’s 2025 Professional Independent Trustee Survey reveals that the 10 largest professional trustee firms now manage over £1trn (€1.15trn) in assets across 2,400 pension schemes.

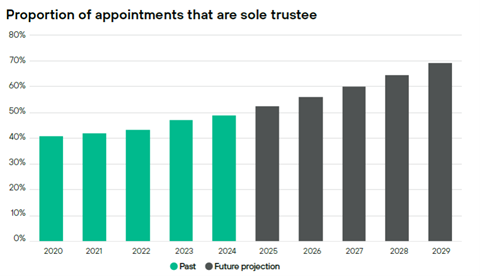

Their market share has grown from 39% in 2020 to 43% in 2024, with projections suggesting they could oversee two-thirds of all DB schemes within five years.

Harvi Rana, director at Isio, said: “The influence of professional trustees will continue to grow, and the regulator’s intentions to introduce a new oversight framework reflects the increasingly key role they will play in safeguarding and securing the future of DB schemes.”

A notable trend driving this growth is corporate sole trusteeship, where a single corporate entity assumes full responsibility for scheme governance. This model now accounts for nearly half (48%) of all trustee appointments and is expected to dominate the market further in coming years due to its efficiency and streamlined decision-making.

Challenges and opportunities

Despite their growing prominence, professional trustees face several challenges. Both LCP and Isio highlight concerns around diversity within trustee boards. While progress has been made – 44% of trustee directors at large firms are now female, according to Isio – representation from ethnic minorities remains low at just 8%.

Addressing this imbalance is critical to fostering inclusive decision-making and avoiding “groupthink”, a risk highlighted by LCP’s findings.

Additionally, trustees must navigate complex regulatory landscapes and balance competing priorities, such as securing member benefits while supporting broader economic goals.

Steve Webb, partner at LCP, cautioned that government reforms aimed at boosting economic growth through pension investments must consider trustees’ constraints.

“Most trustees are open to a conversation about making the most of the money held in their pension scheme, but policymakers need to understand the constraints within which trustees operate.”

The road ahead

As DB schemes mature and approach their endgames, professional trustees will play an increasingly central role in determining their outcomes. Their expertise is vital not only for individual schemes but also for aligning pension investments with national economic objectives.

However, ensuring their voices are heard in policymaking discussions remains a critical challenge.

With both LCP and Isio calling for greater recognition of trustees’ contributions and concerns, there is an opportunity for policymakers to engage more deeply with this influential group.

As Isio’s Rana aptly summarised, professional trustee firms “have secured a position of integral importance in the UK pensions market”. Their continued growth underscores their indispensable role in shaping the future of UK pensions.

Read the digital edition of IPE’s latest magazine