The Aargauische Pensionskasse (APK), the CHF12.1bn (€11bn) Swiss pension fund for the employees of the Aargau canton, has adopted the MSCI low carbon target indexes for its equity portfolio as part of a first step to implement its climate strategy, chief investment officer David Engel said during a discussion panel – Climate change and stranded assets: what are the risks for the pension funds? – organised by Ethos Foundation last week.

The indexes are intended to help identify potential risks associated with the transition to a low carbon economy while representing the performance of the broad equity market – the first indexes designed to address two dimensions of carbon exposure: carbon emissions and fossil fuel reserves.

APK has decided to start its climate strategy implementation with its equity portfolio, as it is “one of the easier parts” to tackle, Engel said.

“We are a passive investor in equities and we think this is a very valuable tool to implement [our] climate strategy in an efficient manner,” the CIO said, adding that there are other steps the pension fund could take to move forward on climate change.

The four elements of APK’s climate strategy include engagement, the use of ESG criteria for specific investments such as real estate and infrastructure, exclusion, and the climate strategy itself, a “new element” that the board approved at the end of last year, he added.

The fund hired an investment risk manager last year to move forward with ESG standards and kick off the new strategy, the CIO said.

“The basic problem we see is the slow transition taking place in terms of climate,” Engel said, adding that this long-term perspective may not be compatible with the short-term business plans of companies.

“We think that there is a big risk for differences in valuations – that is also the basic reason why we are implementing a climate strategy,” he said.

A technology-driven transition

The Carbon Tracker Initiative, a financial think thank researching the impact of climate change on financial markets, has supported engagement with boards since its inception over 12 years ago.

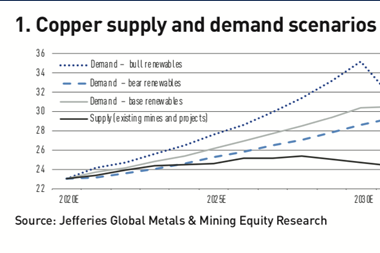

It still believes in energy transition strategies consistent with keeping global warming at 1.5°C or well below 2°C, founder Marc Campanale said, adding that, however, his view changed a few years ago because renewables are now much more competitive.

“Today you have global infrastructure around renewables being built at scale [..] so in this situation engagement is trying to defend a dying technology,” he noted.

He said that engaging with oil and gas companies today is like “engaging with a sector which I am afraid is going to be competed away by technology,” adding that “this is a technology-driven transition”.

APK “heavily debated” exclusion as well. Engel said: “You can put it on your web page, publicly announce it, people ‘like’ it, but you won’t really change the world.”

The scheme still engages with companies, the CIO said.