A new research study that looked into 50 UK pension schemes with a combined $76bn (€62.2bn) in assets under management has shown that the asset owners are looking to increase their allocation to precious and industrial metals.

The study – conducted by NTree International Ltd, a specialist marketing and distribution, and investor education firm – revealed that 78% of surveyed schemes believe that markets have entered a commodity super cycle, a decades-long period during which commodities are predicted to trade above their long-term price trend.

As a result, many asset owners expect to go overweight in commodities such as precious and industrial metals over the next 12 months, it said.

The findings also show that over the next 12 months, 64% of UK pension funds expect to go overweight in their allocation to gold, whilst 42% expect to overweight silver.

Base industrial metals are also starting to attract increasing interest with 40% of funds looking to increase their allocation to the nickel, whilst 46% are also looking to overweight their exposure to copper, the research disclosed.

The study showed that when asked what percentage of their exposure UK institutional pension funds should have to precious metals, 18% said 3-5%, and 66% said between 5-7%. For industrial metals, 44% said their exposure should be 3-5%, 24% said between 5-7%, and 24% said 7-9%.

Only last week the Dutch pension fund for specialty chemicals firm DSM announced a 5% investment in physical gold because of its diversification benefits.

Metals for cleaner energy

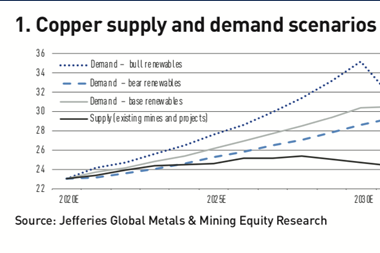

According to the International Energy Agency (IEA), supplies of critical minerals essential for key clean energy technologies like electric vehicles and wind turbines need to pick up sharply over the coming decades to meet the world’s climate goals.

The agency published a report – The role of critical minerals in clean energy transitions – which outlines the central importance of minerals in adopting cleaner energy.

“Demand for these minerals will grow quickly as clean energy transitions gather pace,” IEA said.

Joost van Leenders, senior investment strategist at Kempen Capital Management, said the asset manager is overweight in commodities which consists entirely of gold.

“Gold occupies a diversifying role in the portfolio, traditionally reserved for government bonds. But the extremely low yields are making that increasingly difficult.”

He added: “Gold does of course involve a much higher level of risk than government bonds and this has led us to adopt a small overweight.”

IEA said that the energy sector’s overall needs for critical minerals could increase by as much as six times by 2040, depending on how rapidly governments act to reduce emissions.

“Not only is this a massive increase in absolute terms, but as the costs of technologies fall, mineral inputs will account for an increasingly important part of the value of key components, making their overall costs more vulnerable to potential mineral price swings,” the agency said.