All IPE articles in November 2020 (Magazine)

View all stories from this issue.

-

Asset Class Reports

Asset Class ReportsPrivate markets – Private equity: the impact of COVID-19

The pandemic has devastated some sectors while boosting others

-

-

-

Features

FeaturesIPE Quest Expectations Indicator - November 2020

The two overriding concerns for global markets are the resurgence of COVID-19 cases in many parts of the world and the US elections. In relation to the pandemic it is impossible to know exactly when it will be brought under control. In the US there is a real chance that Joe Biden will win the presidency and the Democrats gain a majority in the senate.

-

Features

FeaturesAccounting Matters: Who sets the standards?

You are what you know, the saying goes. And it goes without saying that the 211 comment letters the International Accounting Standards Board (IASB) received on its Primary Financial Statements (PFS) project will represent some diverse viewpoints.

-

Interviews

InterviewsStrategically Speaking: State Street Global Advisors

In the quaint English game of cricket, there exists a concept that provides a good metaphor for the predicament facing the world in 2020.

-

Opinion Pieces

Opinion PiecesSmart phones: the key to African opportunity

Demographics are often the least appreciated of the long-term trends that investors consider, despite being perhaps the most important.

-

Features

FeaturesPrivate Markets - Agriculture: A growing asset class

Consumer demand, technology and government policies to encourage regenerative farming are creating opportunities for investors

-

Features

FeaturesAhead of the curve: Gold all set to shine during uncertain times

Which asset has no cash flow or yield, has a volatility similar to equities even though its long-term performance lags behind equities, and which has also had long periods of negative returns? Gold.

-

Special Report

Special ReportNot another framework….

Inconsistencies in ESG reporting between corporates and across sectors are widely known. This patchwork quilt of reporting mirrors the array of frameworks and standards for corporate sustainability reporting.

-

Special Report

Special ReportApproaches to engagement

Investors’ approaches to engagement depend on their equity investment strategy

-

Opinion Pieces

Opinion PiecesLetter from Australia: Funding the future world

A handful of Australian superannuation funds are committing their members’ savings to the future world in terms of energy, water, technology and ideas. There will be successes and failures as ideas are developed and marketed.

-

Features

FeaturesBriefing - ILS: resilience despite the thrills

Institutional investors have piled into insurance-linked securities (ILS) with the goal of adding reliable returns and a touch of diversification to their investment strategies.

-

Features

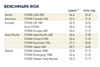

FeaturesBriefing: Tail-risk hedging lessons from the corona crisis

The coronavirus crisis illustrates that equity collar strategies may still have a place for pension funds

-

Country Report

Switzerland: Building up for infrastructure

Will Swiss pension funds increase allocations to infrastructure?

-

Opinion Pieces

Can superfunds be the silver bullet for DB woes?

Consolidation as a means of achieving better outcomes for pension schemes is a growing trend. This was highlighted in the UK’s Department for Work and Pensions’ (DWP) 2018 White Paper on protecting defined benefit (DB) pension schemes.

-

Features

FeaturesPrivate Markets - Venture Capital: The case for VC and growth

European pension funds could significantly improve member retirement outcomes by allocating to venture capital and growth equity

-

Special Report

Special ReportA new standard for carbon investing

The Partnership for Carbon Accounting Financials aims to improve disclosure of the greenhouse gas emissions of financial investments

-

Opinion Pieces

Opinion PiecesLeading viewpoint: Closing ESG reporting gaps

Asset managers seeking a coherent ESG strategy first need a coherent narrative

-

Opinion Pieces

Opinion PiecesLeading viewpoint: How great companies deliver purpose and profit

Shareholder value creation is good for companies, investors and the wider world