All IPE articles in October (2020) Magazine

View all stories from this issue.

-

Interviews

InterviewsOn the Record: Investing in the time of COVID-19

We asked three institutions how they are working to tackle the pandemic, from an investment and organisational perspective

-

Features

FeaturesAhead of the curve: COVID-19 and short-termism: finding the right balance

Finding a way to meet short-term needs without compromising long-term strategy has never been easy for businesses. The radical uncertainty introduced by COVID-19 has made the task much harder.

-

-

Features

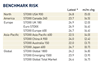

FeaturesIPE Quest Expectations Indicator October 2020

Globally, net equity sentiment is close to record levels, while net bond sentiment is flat or down to near record levels. A scenario explained by a virtual consensus that central banks can continue to pump liquidity into the system and this will eventually kickstart economies. Meanwhile, economists are predicting a long and deep slump.

-

Features

FeaturesAccounting Matters - UK DB pension schemes: One step forward, two steps back

As sometimes happens with Easter, one of the surveys of the UK pensions accounting landscape from consultants Lane Clark & Peacock (LCP) was later than usual. And, like an Easter egg, this keenly awaited overview of the net funding position of FTSE 100 defined benefit (DB) pension schemes comes in two halves.

-

Features

FeaturesLong term matters: Addressing autocratic risk

In an email interview, economist and MacArthur ‘Genius’ Fellow, Emmanuel Saez, confirmed what many investment insiders know: “Markets are notoriously bad at anticipating catastrophes.”

-

Analysis

AnalysisUK DB: Pushback over UK proposals for ‘one size fits all’ funding code

Not long before the UK went into its COVID-19 lockdown this March, The Pensions Regulator (TPR) launched the first of a two-stage consultation on a revised defined benefit (DB) funding code.

-

Opinion Pieces

Opinion PiecesLetter from US: All eyes on CalPERS as CIO quits

The $405bn (€342bn) California Public Employee’ Retirement System (CalPERS) is the bellwether of US public pension funds.

-

Interviews

InterviewsStrategically Speaking: Ambienta

In the early 1990s, when Nino Tronchetti Provera started his career at McKinsey, the management consultancy, sustainability in business seemed little more than a nice idea. But having graduated from Luiss University in Rome with a thesis on the subject, Tronchetti Provera believed in the disruptive potential of making businesses environmentally sustainable.

-

Opinion Pieces

Opinion PiecesLetter from Australia: ESG stirs some ancient ghosts

In May this year, Rio Tinto blew up one of Western Australia’s most significant Aboriginal heritage sites.

-

Country Report

Country ReportFrance: Institutional market barometer

A snapshot of France’s institutional investment landscape as seen through the lens of Indefi’s latest survey

-

Features

FeaturesBriefing: Growth beyond COVID

The outlook for institutional investors may be gloomy, with the global economy in recession and interest rates stuck at extremely low levels.

-

Features

FeaturesBriefing: Which way will inflation blow?

Investors pondering the future course of inflation are scratching their heads – faced as they are with a powerful array of deflationary factors, opposed by a potent lineup of inflationary factors.

-

Features

FeaturesBriefing: Germany finally issues green bonds

There was little doubt that the German finance ministry would eventually tap the green bond market. Germany is committed to reaching net zero greenhouse emissions by 2050.

-

Asset Class Reports

Asset Class ReportsEmerging Market Debt: Covid delivers a booster shot

The pandemic has reinforced the view that ESG-compliant businesses are better able to cope with market shocks

-

Features

FeaturesBriefing: A time to be calm and focused

The corona pandemic has become an emotional rollercoaster for investors. First, came the market collapse, followed by panic sales. Then, hot on the heels of the turmoil, normalisation and new stock-market highs.

-

Features

FeaturesSharing Economy: Think impact, build a legacy

As the world adjusts to COVID-19, amid the uncertainties and dangers that lie ahead, there should still be time to dream of a better world.

-

Special Report

Special ReportValue and Costs: PE gears up for more transparency calls

Private equity is expecting further demand from investors for increased reporting and is checking the maths

-

Features

FeaturesPensions first in move toward UK mandatory climate risk reporting

Mandatory reporting in line with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) has long been a topic of discussion in the UK. It is almost hard to believe that a definitive move to make it policy is only a few months fresh.