All IPE articles in September 2022 (Magazine)

View all stories from this issue.

-

Special Report

Top 1000 Pension Funds 2022: Data

OECD Pension Funds in Figures, 2022 (data for France from 2021 edition); *Data on asset allocation in these figures include both direct investment in equities, bills and bonds, cash and deposits and indirect investment through CIS when the look-through of CIS investments is ...

-

Special Report

Special ReportTop 1000 Pension Funds 2022: Pension assets increase reflects 2021’s markets

The assets of the leading 1000 European pension funds increased by well over €600bn in our latest survey – a large portion of which can be attributed to strong investment returns on the back of a sustained post-COVID rebound over the course of 2021.

-

Features

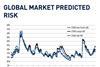

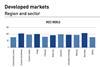

FeaturesQontigo Riskwatch - September 2022

*Data as of 29 July 2022. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

Features

IPE Quest Expectations Indicator - September 2022

The war in Ukraine is characterised by a build-up for the battle for Kherson. The result of that campaign is likely to have great political influence on both sides. Neither is capable of a surprise win, but time works against Russia. In the US, Trump’s legal troubles are serious and mounting, but any Republican successor may be even more destructive. The EU is running against time to prepare for winter. Both optimists and pessimists are over-estimating the ability of technicians to predict the future. Russia has lost the EU as a primary customer for its oil and gas. It must make up for higher distribution costs by offering significant discounts.

-

Opinion Pieces

Opinion PiecesESG Viewpoint: Article 9 of SFDR – the new green lodestar?

Regrettably, the EU’s Taxonomy for Sustainable Activities has gone from proposing “real change” to “may be imperfect”. These are the polite words of EU financial services commissioner Mairead McGuinness. Less politely, Greta Thunberg judged that the taxonomy simply “takes greenwashing to a completely new level [since t]he people in power do not even pretend to care any more. They just label fossil gas as green and nuclear waste as pollution controllable over the next 100,000 years.”

-

Opinion Pieces

Opinion PiecesPrivate managers ‘not serious’ about climate

Fears about the effect of human activity from the climate date from the ancient Greeks, but it was not until the 1980s that scientists began to unite for action on climate change, and the warnings have only escalated since. Too often they have been ignored or denied.

-

Features

FeaturesAccounting: Packed agenda as ISSB takes shape

ISSB board aims to finalise its first two sustainability standards by the end of the year A consultation on the ISSB’s work priorities is planned for later this year The role of materiality in sustainability reporting remains a hotly debated topic

-

Opinion Pieces

Opinion PiecesGuest viewpoint: Pension funds and the EU’s sustainability agenda

The European Commission’s Sustainable Finance Strategy, published in summer 2021, sets out how it will support the EU Green Deal and Europe’s transition to carbon neutrality by 2050.

-

Special Report

Belgium: Limited agreement on pension changes reached

A minimum monthly first-pillar pension will apply from 2024 but there has been little effort to boost supplementary schemes

-

Special Report

Italy: Debate on reform continues ahead of snap election

Plans announced to lower the retirement age and raise public benefits, but there has been little discussion of a greater role for second-pillar pensions

-

Special Report

Finland: New laws passed ahead of unified pensions blueprint

Working group proposals for merging pension systems yet to be published

-

Features

FeaturesAhead of the curve: Are defensive strategies delivering?

Introducing ‘defensiveness’ to equity portfolios can take many forms. At the most explicit end of the spectrum, we can consider dialling down market exposure using derivative-based equity overlays – whether these are static protection programmes or more complex dynamically managed strategies which could even include some implicit volatility trading. At the more implicit end, promising reduced ‘downside capture’, we find a wide array of defensive long-only equity strategies.

-

Special Report

Special ReportUK: Going green amid a regulatory overhaul

The industry is concerned about a focus on derisking as the regulator’s new funding code takes shape this autumn

-

Opinion Pieces

Opinion PiecesNotes from Amsterdam: Reform speeds up consolidation

With each passing day the likelihood diminishes that the law on the future of pensions (Wet toekomst pensioenen) will come into force as planned on 1 January next year. The law was sent to parliament in spring this year, but a date for parliamentary discussion is yet to be set.

-

Opinion Pieces

Opinion PiecesAustralia: Downturn casts a shadow over super anniversary

Australia’s superannuation industry enters its fourth decade under the darkening clouds of a global economic slowdown that is already having a dramatic impact on returns.

-

Special Report

Denmark: Commission heralds comprehensive approach

Expert body tackles complexity, incentives, tax and indexation

-

Special Report

Special ReportGermany: Unlocking innovation and improving risk assessment

The German government is encouraging institutional investors to invest in venture capital funds to help support start-up companies

-

Special Report

Austria: Debate on pension reforms continues

Promises to review Austria’s pension system made over recent years have not materialised, resulting in a renewed push for action by the pension industry

-

Asset Class Reports

Asset Class ReportsEquities – Are Paris-aligned benchmarks a climate gamechanger?

Inflexible annual carbon reduction targets and weak data can lead to flawed decision-making