Arab financials are ideal partners for European pension funds and investors, writes energy market expert Cyril Widdershoven

Key points

- Cost of energy transition is staggering; addressing it will need the cooperation of all players

- Fossil fuel producers in MENA region are also among biggest investors in renewable energy

- Climate discussions should not forget geopolitics

- Opportunity for emerging and developing countries to have their voices heard

All eyes are on COP28 2023, which starts in Dubai today.

The 28th annual climate conference convened by the United Nations is headed by Sultan Al Jaber, who is also group chief executive officer of Abu Dhabi National Oil Company (ADNOC) and head of the United Arab Emirates’ giant renewable investment and operating company Masdar.

Much has been written about the controversial appointment of an oil and gas champion to lead COP28. The reality is that the appointment of Al Jaber to the position by UAE president Mohammed bin Zayed (MBZ) is not only a sign that hydrocarbons are still in play in the global energy system, but also that the call for inclusivity is not just a media-centric approach.

In Dubai all economic sectors, policymakers and non-governmental organisations (NGOs) will be at the table, making it again a potential global discussion forum that will lead to action. Still, the main discussion is not the necessity to find solutions to counter the negative impact of global warming and climate change, but is mainly focused on the role of fossil fuels and lobbying of ‘big oil’.

Al Jabr has repeatedly stated that COP28 will not be a discussion between hydrocarbon dinosaurs and the greens, but should be focusing on the already immense but still increasing challenge of financing a just and prudent energy transition – and decarbonisation – of the global economy. Without global cooperation of countries, industry, innovators and financial institutions, the results of COP28 will be as meagre as the previous 27 COPs.

Staggering transition costs

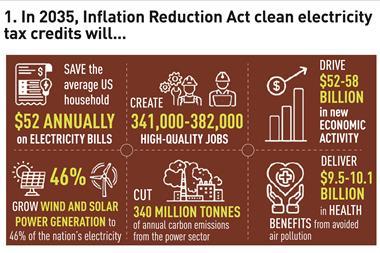

The projected costs of the global energy transition are already staggering. The International Renewable Energy Agency (IRENA), based in Abu Dhabi, has said that the expected investment needs for a successful energy transition by 2030 are likely to be more than $35trn (€32trn).

IRENA also emphasised that, until 2050, around 41% of all energy-related investments will be linked to hydrocarbons. From these investments, $1bn each year after 2030 should go to additional renewable-energy investments.

The OECD’s energy watchdog, the International Energy Agency (IEA), is even harsher, indicating the $1.7trn invested in renewable energy and the transition in 2023 will need to rise to $4.4trn a year by 2030 to put the world on track to reach net zero emissions by 2050.

Out of touch with reality

The figures are staggering, but looking at the markets and commodity sectors, the IRENA and IEA predictions may be too low. The offshore wind industry is in a financing crisis as interest rate rises combine with increased prices for materials, leading to plunging profits.

The desperate stories of Vattenfall, Orsted, Siemens Energy and China’s GoldWind show more is needed quickly. Policymakers are, however, optimistic that the expansion of offshore wind, solar and hydrogen could produce 10,000 gigawatt of power in 2030, an increase of 7,000GW from 2023.

However, realism is at the table at COP28, with the global South and others planning a showdown. Emerging and developing countries are not able or willing to forfeit their future based on OECD assessments and strategies. Most of the global South is unable to finance an energy transition while being dependent on Western or Asian (China, Japan) financing structures.

Most want to monetise their own natural resources (oil, gas, coal) to set up a feasible economic growth strategy, able to eventually finance their own indigenous energy transition or decarbonisation plans.

Major economies such as India, China and Russia, as well as the Middle East and North Africa (MENA) are also unwilling to interrupt their economic growth and diversification plans by removing or halting hydrocarbon projects. In the end, the energy transition costs money, which most countries must first earn.

Does this mean COP28 will be a tradeshow for hydrocarbon zealots, international and national oil companies and energy-intensive industries? Looking at Al Jaber’s plans, it will not, judging by the UAE and other Arab countries’ ongoing energy transition investments and economic diversification.

Most Arab countries have embraced the energy transition due not only to climate change or global warming issues but simple economic factors

The region is slowly but exponentially building up its sustainability credentials. Since the signing of the Paris Agreement in 2015, the Gulf Cooperation Council (GCC) countries have embarked on major climate-linked projects and renewable energy investments. Five out of the six GCC countries have committed to reach net zero by 2060 or before. The UAE and Saudi Arabia are aiming to decarbonise even earlier, but reality still keeps their policies in check.

Most Arab countries have embraced the energy transition due not only to climate change or global warming issues but simple economic factors. Most oil and gas producers acknowledge that these natural resources are finite, so new energy is needed. Geographically they are well positioned. The potential for wind, solar and hydrogen or ammonia is immense, while they are also placed between the two main markets, Europe and Asia.

Vital role of MENA

The multi-billion investment plans of the UAE and Saudi Arabia in renewable projects in domestic and global markets is an indication that the region will play a pivotal role in future. Entities such as Aramco, ADNOC, Mubadala, Masdar, ACWA and Fertiglobe will be the new revenue base when oil and gas are no longer viable fuel sources.

This is important, as hydrocarbons are increasingly seen as products, such as plastics or fertilisers, and not a one-off fuel. International consultancies such as PwC and Deloitte have already stated that MENA will be pivotal for green energy, while Arab financing will be an essential element.

According to Arab analysts, Western pension funds and investors talk the talk of climate change and the energy transition, but Arab funds are walking the walk

Financing will be key to not only the success of COP28, but also as an instrument of cooperation between West and East. Financial institutions such as banks and pension funds are already key to renewable energy projects. While the availability of financing in the West is not yet a real problem, it will not remain so for ever. Arab countries have the financing and are cash-rich. Listed GCC-based banks hold assets of more than $2.6trn, with Arab sovereign wealth funds (SWFs) the hidden force.

SWFs such as Saudi Arabia’s Public Investment Fund, Abu Dhabi’s ADIA and Mubadala, the upcoming giant International Holding Corporation (IHC), QIA and others already play a major role in the roll-out of energy transition-related projects in the region but also increasingly worldwide. Abu Dhabi’s unknown giant Masdar, owned and financed by ADNOC, is already heavily involved in offshore wind and solar projects around the world. Arab investment funds have set their eyes on the sector.

At the same time, Arab utilities, such as Saudi’s ACWA Power or Egypt’s TAQA Arabia, will be playing a major role worldwide, but especially in Europe and Africa in the coming years.

They are key stakeholders, not only in renewable energy projects but also as power brokers inside the Arab world and as potential partners for Western project developers. COP28 will be the ultimate discussion forum to set up this long-term cooperation, which is needed by all, but especially to bring the global South in play and support struggling Western strategies. As long-term investors, Arab financials are ideal partners for European pension funds and investors. Their long-term approach, partly risk adverse, is in line with European pension funds.

Western pension funds, wary of engaging with hydrocarbon countries or oil and gas-backed investment funds, need to dramatically change their thinking, and cooperation seems a no-brainer. According to Arab analysts, Western pension funds and investors talk the talk of climate change and the energy transition, but Arab funds are walking the walk. Money and profits can be combined with greening the future.

Geopolitical threats

The COP28 leadership has already reiterated the need to decarbonise the energy system, triple renewable-energy capacity and double energy efficiency. The main stumbling block remains financing and the stability of the energy and economic system. Having a hydrocarbon giant on board opens new doors. Oil and gas companies worldwide are the backbone of the renewable energy transition, and its largest investors.

Holding COP28 in the Arab world is inspired

COP28 comes at a crucial geopolitical power struggle, with not only the Russian invasion of Ukraine, but also the destabilising effect of the war between Israel and Hamas in the MENA region. Geopolitical power plays at COP28 are to be expected, as compromises between the US and China, or the West with Russia, are not feasible.

Holding COP28 in the Arab world is inspired; it opens doors to everyone. In how far economics and geopolitics will be taking over will depend on the coming weeks.

But further destabilisation of the Middle East, or increased tensions between the West, China or Russia, could bring everything to a standstill. Climate change and the energy transition present both a geopolitical power opportunity and threat. Al Jaber’s task has not become easier.

The author is an energy market expert and founder of consultancy Verocy