Defined contribution – Page 30

-

News

NewsUK government consults on decumulation in trust sector

DWP exploring what support savers need and what decumulation pension products and investment options are available

-

Features

FeaturesAI could help triple Europe’s private debt market

Investors seeking higher yield have driven the growth of the private debt market. European private debt, though still much smaller than the US market, has also been growing rapidly. European lenders managed assets of $350bn as of June last year, according to Preqin, in a total market of $1.19trn. This is more than double the level in December 2016.

-

Interviews

InterviewsOpenbare Apothekers Pension Fund: Preparing for change

Ronald Heijn and Maarten Thomassen of the Netherland’s Pensioenfonds Openbare Apothekers tell Tjibbe Hoekstra about the impact of the Dutch pension reform on their fund

-

Opinion Pieces

Opinion PiecesIlliquid assets could bring cost burden

Last month the UK’s Department for Work and Pensions (DWP) closed its consultation on ‘Facilitating investment in illiquid assets’, which sought views on policy proposals and draft regulations designed to improve the accessibility of illiquid assets for defined contribution (DC) pension schemes.

-

Opinion Pieces

Opinion PiecesDelay looms to Netherlands reform process

The Dutch government has vowed to finalise the country’s hotly debated switch to a pension system with defined-contribution variants by 1 January 2023.

-

News

NewsNew pension projection rules could generate ‘perverse’ results, LCP warns

Consultancy argues against proposed volatility-based approach for determining DC accumulation rate

-

News

NewsNavigate private market complexity to achieve goals, trustees told

As the UK government urges DC schemes to invest in a wider range of illiquid assets, trustees are told not to fear the unfamiliar

-

News

NewsUK pensions industry urges regulators to focus on ‘more than just costs’

‘A transparent, consistent framework also needs to consider factors such as investment performance and quality of service,’ says LGIM

-

News

Social partners plan to expand DC model for chemical industry to further sectors

BAVC and trade union IGBCE expect to start the new pension model from 1 October 2022

-

News

Hybrid pension funds want clarity on pension transition

Dutch multi-sector schemes including PGB, PNO Media and SBZ Pensioen fear they may not be able to make the switch to DC under the proposed legal framework

-

News

Achmea acquires ABN Amro DC pension vehicle

The insurer expects it can accelerate the growth and profitability of the €3.5bn second pillar DC pension vehicle

-

Opinion Pieces

Opinion PiecesGuest viewpoint: How can DC schemes build a more sustainable future?

The UK government’s Build Back Better growth plan paves the way for significant investment in infrastructure, which could be attractive for defined contribution schemes. How might they take advantage of opportunities to improve outcomes for savers?

-

Country Report

Country ReportUK: Collective defined contribution pensions move up a gear

The first collective defined contribution pension scheme is set to launch after years of stop-start progress. But obstacles remain

-

Country Report

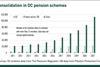

Country ReportUK: The long and winding road to consolidation

Brexit, COVID and other factors delay regulation that would enable commercial DB scheme consolidators to operate

-

News

Rabobank to close CDC arrangement

The firm will instead introduce a separate DC arrangement in the run-up to the pension transition

-

News

NewsUK roundup: Fidelity, Tumelo launch stewardship hub

Plus: Act quickly to lock in funding gains, says Hymans Robertson; LGIM reports on latest DC savers’ preferences

-

News

Take account of stagflation in ALM studies, say consultants

The likelihood of stagflation has risen, but still insufficient funding ratio prevent pension funds from taking appropriate action

-

News

German trade union, associations agree on first industry-wide DC pension model

Until the end of June BAVC and IGBCE will work out rules for a collective bargaining agreement to start a pure DC scheme

-

News

APG lacks IT staff for pension transition

The shortage in IT staff has already led APG to delay a number of IT projects

-

News

Co-ordinated UK industry campaign bids to crack pension engagement nut

15 providers and schemes support concentrated engagement season campaign being led by ABI and PLSA