All IPE articles in ETFs Guide 2019 – Page 2

-

Special Report

ETFs for ESG: Sustainable investing is here to stay

Sustainable investing was once viewed as a trade-off between value and ‘values’. Yet today, it’s something investors can no longer afford to ignore.

-

Special Report

Liquidity & Implementation: Woodford fallout renews focus on ETF risks

The recent suspension of redemptions from Neil Woodford’s Equity Income fund is a cautionary tale and one that has further sharpened the spotlight on the liquidity of mutual funds, a category that includes exchange-traded funds (ETFs).

-

Special Report

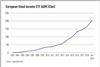

Focus on Fixed Income: The rise and rise of fixed income ETFs

When ETFs first broke up the active management party in the fallout of the financial crisis, it was equity funds that bore the brunt of the impact.

-

Special Report

Focus on Fixed Income: ETFs: the natural home for fixed income

In recent years, fixed income ETFs have been grabbing a larger slice of the ETF market as investors look to capitalise on the enhanced diversification, tradeability, price transparency and liquidity they can provide to bond portfolios. According to the latest research by Citi Business Advisory Services, fixed income ETF assets have increased at a robust 25% annual compound growth rate over the last decade, hitting more than $870bn by the end of 2018.

-

Special Report

Liquidity & Implementation: The shifting sands of index provision

As ETFs are created to track ever more specialised market exposures, competitive pressures and new regulations are impacting the complex relationships between asset managers and index providers.

- Previous Page

- Page1

- Page2

- Next Page