All Features articles – Page 39

-

Features

FeaturesFixed income, rates, currencies: Hope but also fears for 2019

US domestic investors hold healthy stock market profits after a decade-long bull run Geopolitics on many fronts point to tumultuous times ahead

-

-

-

Features

FeaturesAhead of the curve: MiFID II increases asset risk

Attempts to improve transparency of research costs have unintentionally hit performance

-

Features

FeaturesHow far should auto-enrolment go?

Some are contemplating whether auto-enrolment into pension funds could be expanded to help savers in other areas of their financial lives

-

Features

FeaturesResearch - Europe: Investors braced for an era of lower returns and higher volatility

In the second of three articles on a new survey, Pascal Blanque and Amin Rajan argue that pension investors are adapting to challenges that go beyond the realms of a maturing business cycle

-

Features

FeaturesBriefing: Collateral challenges

Rising interest rates put collateral management strategies to the test

-

Features

FeaturesBriefing: Trade war, a primer

Protectionism is becoming more widespread despite the benefits of free trade being understood for more than two centuries

-

Features

FeaturesBriefing: MiFID II: a year on

The new rules are having a dramatic effect on the world of investment research

-

Features

FeaturesDouble standards on trade

No wonder the discussion of trade is in such a tangle. The terminology around the subject is almost designed to cause confusion.

-

Features

FeaturesExit Interview: Peter Hansson

Peter Hansson, former CEO of Sparinstitutens Pensionskassa, decided to retire after 25 years with the pension fund for savings institutions in Sweden as new regulatory changes loom

-

Features

FeaturesA glimpse into the future

For many people, being asked to solve their retirement planning problems is akin to being asked to build their own car

-

Features

FeaturesInvesting is not a zero-sum game

The rampant bull market of the past decade could already be a thing of the past and institutional investors are understandably nervous about the future

-

Features

FeaturesChecking back on 2018

In January, in this column, I highlighted areas to watch for 2018. In the spirit of holding myself to account, it’s time to see how they panned out

-

Features

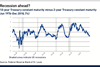

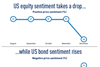

FeaturesIPE Expectations Indicator: December 2018

At times we aim to find the mountains within the molehills of manager expectation shifts. In our defence, any curvature is worthy of recognition. Sometimes, changes (or lack thereof) come along that are worth diving into. In the prior survey, it was the four-month lack of change within the high sentiment toward US equity markets to rise that was significant. During the current period, hyperbole aside, change has come.

-

Features

Accounting Matters: The audit F-word

Increased incidence of accounting fraud raises questions about UK audit standards

-

Features

Credit allocations: Time for a re-balancing act

Investors are ignoring indicators that should encourage a more selective approach to credit

-

Features

Fixed income, rates, currencies: Challenges still lie ahead

While the US mid-term elections saw the Democrats regain the House of Representatives, trade policy remains in the hands of the White House. Trade tensions, between the US and China in particular, will remain to the fore. President Trump’s aggressive trade policy is already having a global impact with declining purchasing manager indices indicating corporate hesitation in future plans.

-

Features

Ahead of the curve: Sporting a safety jacket in a market of weak protections

Funds that take on loans that have been rejected by banks are likely to be problematic for investors

-

Features

FeaturesDutch reform: ‘Complexity and stubbornness killing world’s best pensions system’

Despite ranking as the world’s best in the Melbourne Mercer Global Pension index, the Netherlands’ pensions system is being hit by too much complexity and ineffective regulation