All Features articles – Page 34

-

Features

IAS 19: How did they do it?

Two academics have analysed key amendments to IAS 19 and how they came about

-

-

-

-

-

Features

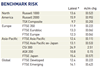

FeaturesIPE Quest Expectations Indicator: July 2019

Markets are still driven by political risk and growth prospects. It looks like the two risks are working in the same direction this month.

-

Features

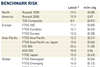

FeaturesIPE Quest Expectations Indicator: August 2019

It looks like political risk is taking a back seat to growth this month, continuing last month’s trend.

-

Features

FeaturesFixed income, rates, currencies: Nervousness abounds

The weak US non-farm payroll (NFP) data for May, far below forecasts, sent rates falling and stocks rising, on the supposition that it raised the likelihood of interest rate cuts from the Federal Reserve. On the other hand, while risk markets cheered the prospect of easier money, the hardline approach taken by the US towards China, and China’s uncompromising responses are raising investor nervousness.

-

Features

FeaturesResearch: Passive investors, active owners

The rise of index investing raises important question about ownership rights and governance

-

Features

FeaturesAdequacy: the all-important question

How do you measure success when it comes to pension reform? In the UK, it is clear that the government measures the success of auto-enrolment by some numbers, but not others.

-

Features

FeaturesDutch pensions agreement dodges the real issues

Social partners have agreed compromises relating to the state pension age and early retirement Many crucial aspects are yet to be confirmed and could still derail efforts to reform the system

-

Features

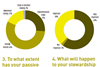

FeaturesAhead of the curve: The bubbles to come

Market bubbles would not happen in a perfect world. But humans are not perfect and our economies are inherently unstable.

-

Features

Editor's Notes: A radical ambition

Last month’s three doorstop reports from the EU’s 35-strong technical expert group (TEG) on sustainable finance have the potential to radically repurpose capital markets.

-

Features

FeaturesPerspective: Growing buzz around cannabis

Legalisation of cannabis raises ethical questions for some investors, while presenting an investment opportunity for others

-

Features

FeaturesLiquidity: Bad timing

Pension funds lose billions annually in badly timed trades in the capital markets

-

Features

FeaturesEC’s expert group releases landmark climate taxonomy

The European Commission’s expert group on sustainable finance last month published its long-awaited final recommendations for a taxonomy of environmentally sustainable activities, which is at the heart of the EU executive’s plan to harness the finance sector for its fight against climate change.

-

Features

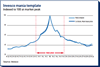

FeaturesThe Disneyworld trap

The remarkable reversal in the outlook for official interest rates over the past few months has received relatively little attention. Until recently it was widely accepted that rates could only move upwards. It looked almost certain that quantitative tightening (QT) would supplant quantitative easing (QE). Now the balance has reverted to further monetary accommodation.

-

Features

FeaturesESG: Greenwashing under scrutiny

The term ‘greenwashing’ was reportedly coined by US environmentalist Jay Westerveld in 1986 in an essay about hotels’ practice of putting up notices in hotel rooms to encourage guests to reuse towels. He accused them of making false claims about being environmentally responsible since they only adopted such practices when they reduced costs.

-

Features

FeaturesItaly’s first-pillar obsession

Italy’s anti-establishment, eurosceptic coalition government has partly delivered on its promise to reform the pension system. ‘Dismantling’ the 2011 pension reform that curtailed benefits and raised the retirement age was key for both coalition partners – the Five Star Movement and the Lega. Previous governments had raised the retirement age.

-

Features

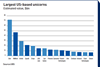

FeaturesIPOs: Unicorn hunting

“Public interest in IPOs hasn’t been this high since the dot-com era of the late 1990s,” say analysts at UBS. Such popularity is stoking fears of a bubble in unicorns – privately-financed start-ups valued at over $1bn (€900m) taking listings.