All Features articles – Page 29

-

Features

FeaturesBriefing: Long-term investing: it’s up to the pension board

A practical framework for pension fund trustees looking to implement long-term investment approaches

-

Features

FeaturesESG: Keeping tabs on offsetting

Portfolios companies’ net-zero commitments often imply use of offsets, which carry risks

-

Features

FeaturesNuclear power: The need for nuclear

Nuclear energy is key to tackling the existential challenge posed by climate change

-

-

-

Features

FeaturesIPE Quest Expectations Indicator: April 2020

This months’ figures were collected before the successive stock-market slumps.

-

Features

FeaturesFixed Income & Credit: Potential for adventures

Emerging-market local-currency corporate debt is under-explored by global investors

-

Features

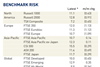

FeaturesAhead of the Curve: The mega-cap conundrum

Last year was challenging for quantitative equity strategies with a large proportion of them underperforming their benchmark on a rolling one-year basis. There has, therefore, been a great deal of interest in understanding the shortcomings of quantitative portfolios over the same calendar year.

-

Features

FeaturesResearch: The new benchmarks

Sustainability is set to become the gold standard of investing

-

Features

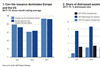

FeaturesBriefing: Europe turns Japanese

Despite the more immediate concerns of the COVID-19 pandemic, the spectre of ‘Japanisation ’ casts a dark shadow over euro-zone investment markets. It is possible that the current crisis will supercharge the pre-existing trend for Europe to follow Japan’s economic and financial experiences.

-

Features

FeaturesBriefing: A safe haven

Treasuries, the yen, and gold all traditionally serve to harbour investors in times of stress. A closer look at the current demand for Treasuries, however, paints a complex world view with implications for financial markets. Yields suggest it might remain ugly for another decade.

-

Features

FeaturesFixed Income & Credit: Loan covenant high tide?

Fitch Solutions outlines just how far covenant terms have steadily shifted in borrowers’ favour – at least until coronavirus hit

-

Features

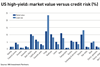

FeaturesFixed Income & Credit: High-yield worries grow

Global high yield and loans still offer attractive returns but the worry is about the stage we are in the credit cycle

-

Features

FeaturesFixed Income & Credit: Credit at a crossroads

How will weak lending standards hurt credit investors in a global slowdown?

-

Features

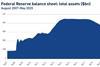

FeaturesFixed income, rates, currencies: Global economy under pressure

At the end of February, after a week that saw stock markets around the world plummet, US Federal Reserve chair Jerome Powell sought to calm fears, saying that the Fed would “act as appropriate” to support growth.

-

-

-

-

Features

FeaturesLong term matters: To investors who care about the climate crisis – act before COP26

Rather belatedly, we have a new president of COP26 in the form of Alok Sharma, former UK international development secretary. But this sorry saga seems quite symbolic – we know that we need to do something big but we can’t quite get our act together.

-

Features

FeaturesIntegrated reporting: Accounting goes sustainable

Combining conventional financial reporting with non-financial reporting in a single integrated framework presents challenges