All Features articles – Page 24

-

Features

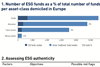

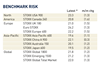

FeaturesBriefing: Tide turning for ESG fixed-income

The supply of ESG-aligned bonds is increasingly underpinned by regulatory pressures and client demand for products targeting non-financial objectives. As the investable universe grows, so the number of funds and assets will increasingly find their way towards fixed-income ESG solutions. However, to strike the right balance between financial and non-financial returns investors should look for ESG-authentic leaders with good risk-return capabilities

-

Features

FeaturesStrategically Speaking: Mondrian Investment Partners

Clive Gillmore is a rarity nowadays among asset management CEOs in that he is keen to discuss what he sees as the difficult moral choices embodied in ESG investment

-

Features

FeaturesPerspective: Targeting net zero

Ambitious ‘net-zero’ carbon reduction goals are the latest in the evolution of asset owners’ engagement with climate change

-

-

-

Features

FeaturesIPE Quest Expectations Indicator - January 2021

US COVID-19 figures were rising rapidly at the time of writing. Western European figures were divided. Many showed a climbdown from the second wave but Germany, the UK and the Netherlands were faced with growing figures. Japan’s statistics were up, forming a third wave. In a few weeks, we will know how the deployed vaccines work in practice.

-

Features

FeaturesAhead of the curve: Options trading as a portfolio diversifier: pilot or passenger?

Options can provide insurance against market volatility, but require detailed knowledge to ensure success

-

Features

FeaturesStrategically Speaking: Hendrik Bartel, TruValue Labs

What makes ESG data providers stand out? For TruValue Labs, the answer is to apply AI and machine learning to thousands of unstructured data sources to enhance ESG investment processes

-

Features

FeaturesBriefing: Japan emerging from its invisible lockdown

Japan is all too often portrayed as being different from other countries. Not just distinctive in the obvious sense that every country has its own national peculiarities. Instead, somehow unique in a way that makes it stand out from every other country.

-

Features

FeaturesBriefing: Still a strong case for US stimulus

The next awaited US stimulus programme remains a mystery. Congress must agree on funding specifics, but the final composition of the Senate will be unknown until this month. Republicans and Democrats have been battling over spending priorities since COVID-19 struck last spring, with competing priorities.

-

Features

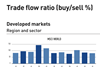

FeaturesFixed Income, Rates, Currencies: A very different recovery

Amongst the remarkable happenings in 2020, from startling news of a pandemic to viable vaccine and beyond, has been the speed and scale of interventions from central banks and governments.

-

Features

FeaturesLong term matters: What kind of decarbonisation matters most?

This article was written on the fifth anniversary of the Paris Agreement. In 2015, the world committed to keep warming below 2°C, meaning decisive annual reductions in greenhouse gas (GHG) emissions. Instead we have had a 7% increase in GHG since 2015 and are on track for about 3°C warming with a high risk of irreversible tipping points.

-

Features

FeaturesESG: Engaging with sovereigns

One of the narratives and unfolding developments in the world of ESG is that of its broadening to asset classes beyond public equity. This generally keeps the focus on corporates, however, while another emerging strand is about sovereign issuers.

-

Features

FeaturesPerspective: Litigation - state of pay?

Changes in legislation like the UK’s Consumer Rights Act 2015 have led to an increase of class actions led by pension funds as they seek to recover investment losses

-

Features

FeaturesResearch: The shift from virtue to value

In the final article in a series of two, Pascal Blanqué and Amin Rajan argue that the success of ESG investing rests on a just transition to a low carbon future

-

-

-

Features

FeaturesIPE Quest Expectations Indicator - December 2020

US COVID-19 case numbers were rising rapidly at the time of writing. Western European figures suggest that the lockdowns are repelling the second wave. Japan’s statistics suggest a third wave is coming. Only an efficient vaccination and a high participation in inoculation programmes can end the threat posed by COVID-19.

-

Features

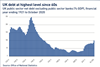

FeaturesAccounting Matters: Accounting for the Wedge

The reason why defined benefit (DB) scheme sponsors account for inflation is because International Accounting Standard 19, Employee Benefits, tells them that if they make a benefit promise that is linked to price increases, the effect of that commitment has to be accounted for. The starting point for what by any standards is a gargantuan actuarial task is to look at yields on inflation-linked bonds.

-

Features

FeaturesLong term matters: A time to be hopeful and active?

Jaap van Dam, principal director of investment strategy at PGGM, is right: pension funds need to understand politics. We have two additions. First, the ‘outside-in’ focus – how politics affects portfolios – is a great starting point. But investors cannot stop there, they have considerable influence on politics whether for good or bad.