All Features articles – Page 23

-

Features

FeaturesSelectivity is key in SPAC market

The vogue for special purpose acquisition companies (SPACs) has something in common with many other fashions, whether in investment or in the shops. Just when you think the trend cannot get even hotter, the temperature rises yet further.

-

-

-

Features

FeaturesIPE Quest Expectations Indicator - March 2021

Vaccination figures are rising steadily, but are still at a relatively low level. The US and UK, both important vaccine producers, lead the field with the EU and Japan lagging. As the speed of vaccination has increased, supplies have become a problem, except in the UK. This has caused bad feelings in the EU to the point where a trade war was threatened. New vaccines are in the regulatory pipeline but market shares have largely already been divided in the developed countries. The discovery of new COVID-19 mutations and their resistance to vaccines are an additional risk.

-

Features

FeaturesStrategically Speaking: Capstone Investment Advisors

Last spring’s exceptional market volatility proved the mettle of at least one set of strategies – volatility-focused hedge funds. The CBOE Eurekahedge Tail Risk Hedge Fund index returned a bumper 51.64% in the first three months of 2020 alone against a broad hedge fund market index return of -7.96%, and was up 34.8% for the year.

-

Features

FeaturesAhead of the curve: Alternatives investing in a low-yielding world

Investors hoping to replicate bond-like returns (low to mid-single digit, low volatility and drawdown) are facing an unenviable predicament. How can they generate acceptable, positive returns without simultaneously suffering illiquidity, valuation uncertainty, gap risk, and other hard to quantify risks?

-

Features

FeaturesChina: Caught in the crossfire

The investment world is at risk of being caught in the midst of a ‘geoeconomic’ conflict between the world’s main economic blocs

-

Features

FeaturesHedge funds: Coping with low interest rates

Historical analysis suggests portfolios of certain quant hedge fund strategies may offset some of the risk of rising interest rates

-

Features

FeaturesFixed Income, Rates, Currencies: Priming the pump

Although COVID-19 infection rates are falling across many regions, the ‘success’ is more a reflection of lockdown restrictions keeping opportunities for virus spread low.

-

Features

Rising interest in EM debt

The weak dollar and low US interest rates are pushing governments and companies in emerging markets (EMs) to issue growing volumes of dollar-denominated debt.

-

Features

FeaturesPerspective: Pooled investors gain a vote

A disruptive new service allows institutional investors in pooled funds to express their stewardship preferences. Will others follow suit?

-

Features

FeaturesFixed Income, Rates, Currencies: Same again in 2021?

The relief from the farewells to 2020, and welcoming a Brexit trade deal, has waned in the face of rising COVID-19 infection rates. There have also been further lockdowns across swathes of Northern Europe as well as in Japan, Thailand, and South Africa to name a few. The vaccine-generated light at the end of the tunnel which appeared last year, seems rather distant, and possibly dimmer too.

-

-

-

Features

FeaturesIPE Quest Expectations Indicator - February 2021

Interest has shifted from contamination and mortality data to vaccination figures. In this field, the US and UK are doing well, while the EU and Japan are lagging. Political risk is perceived to have gone. Donald Trump’s tendency to self-destruct is creating opportunities for the Republican Party to heal while Democrats are preparing an economic support package.

-

Features

Accounting Matters: Auditing the auditors

There is widespread consensus that the audit sector is not fulfilling its potential, and that previous attempts at reform have been ineffective. As the impact of high quality audit goes far beyond the boardroom, when pension funds rely on audited financial statements for their capital allocation decisions, it is ultimately their individual members’ capital that is at risk.

-

Features

FeaturesBriefing: Active ways to prosper in EMs

On the battlefield on which active managers fought their passive enemies for investors’ custom, there was one patch of higher ground that seemed easier to defend – emerging market equities.

-

Features

FeaturesAhead of the curve: Has the period of painless diversification ended?

With interest rates falling to historical lows the reality of a new financial landscape is confronting investors. It is one where the typical relationships between assets has come into question. In addition, basic ideas around diversification and portfolio construction no longer seem to match with the available investment opportunities.

-

Features

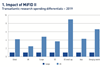

FeaturesBriefing: The sum of all fears

Three years on from the onset of MiFID II, market participants, governments and regulators are assessing its outcomes and considering adjustments.

-

Features

FeaturesLong-term matters: Stop investing in autocracy

Europeans observing the US ‘near miss’ constitutional crisis have a choice – be spectators or show responsibility